Easy and Simple Guide To Understand What is a Call Option

When we are facing the option market, one of the first questions we should ask ourselves is what is a call option because understanding the call option definition is key to comprehend how the option market really works.

In this guide we are going to take a look at what a call option is and how does it work. Also, we will see when to sell a call option and when to buy it and every question we may have.

Table of Contents

Let us begin with the basics…

What is a call option?

A call option, along with the put option, is one of the two basic ways to open a trade in the options market.

When an option trader wants to open a trade in the market, he can either buy or sell a call option depending on what he expects to happen in the market.

If the trader buys the option, we could say he is being long. However, if the trader decides to sell, we could say he is either short or a writer of a call option.

How does a call option work?

In order to explain how a call option works, the best we can do is to compare it to how a stock works in the stock market.

Let us suppose we want to buy a few stocks. What we would do is access our brokerage account and place either a limit or market order to obtain the titles so we can sell them in the future to obtain some money.

In the options market, when we want to open a long position, we are going to buy a call option.

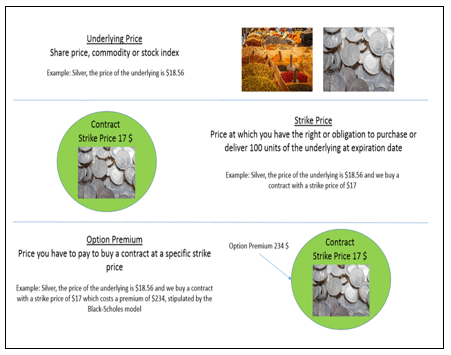

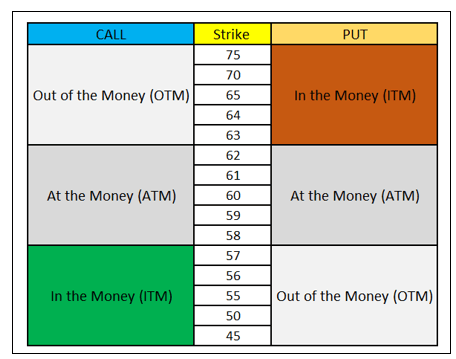

In this case, we are paying to obtain the right to acquire some titles of a stock at a certain price, called the strike price and until a determined date, called the expiration date.

An example of how to buy a call option

Let us suppose we access the option market and buy a call option from Nike for a strike value of $100 at the expiration date of May 30, 2020. What we are doing is acquiring the right to buy 100 shares at that price ($100) until May 30 of this year. This will happen regardless of the share price in the future, as this is the call option definition.

This is because the seller of the call option has committed to sell us those shares, whatever happens in the market, and until the expiration date that we have stated.

Now, we have to distinguish two essential facts.

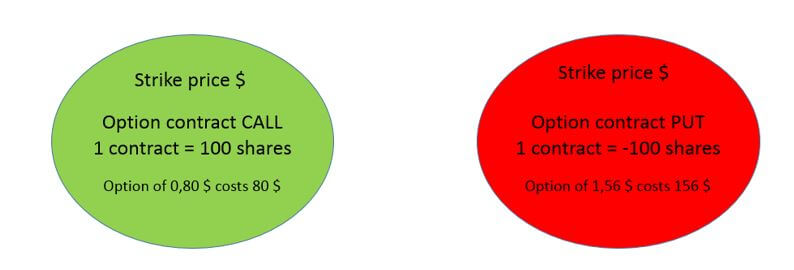

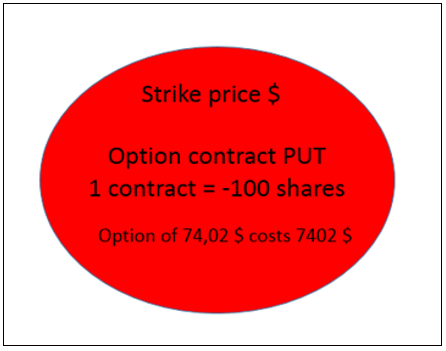

When we buy or sell a call option, the option premium, which is the price at which we pay the call option, will be given in terms of cents. For our example, if the option premium costs $0.80, we will actually have to multiply it by 100 to get the real value we are going to pay.

The fact that we have to multiply by 100 is because each option contract is made up of 100 shares. This is regulated by the option market. Whenever we want to buy or sell stock options, they will be in lots of 100, and their price in the option chains will appear in cents.

If you want to learn more about how to buy a call option with much more detail, we highly recommend you to take a look at this article in which we explain everything you need to know!

When to buy call options?

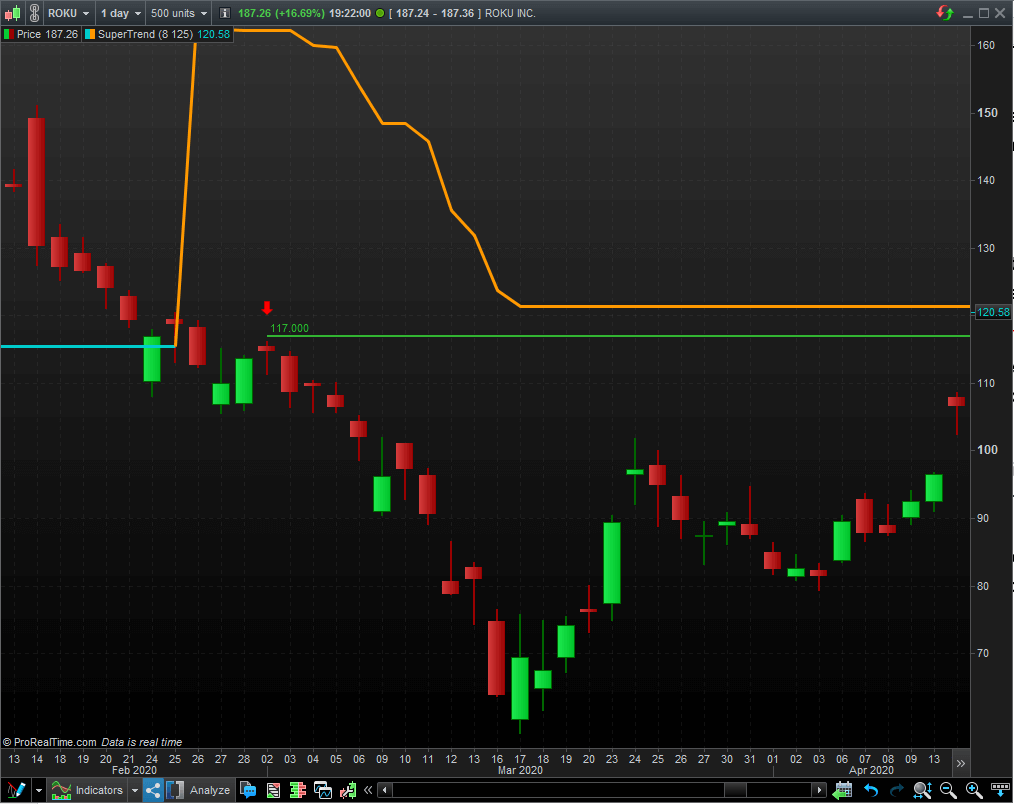

We are going to suppose that we have a portfolio of approximately $3000, and we want to invest in the company Roku, which has a strong growth potential. The value today is $103 per share, so if we wanted to buy shares, we would get less than 30 shares per share.

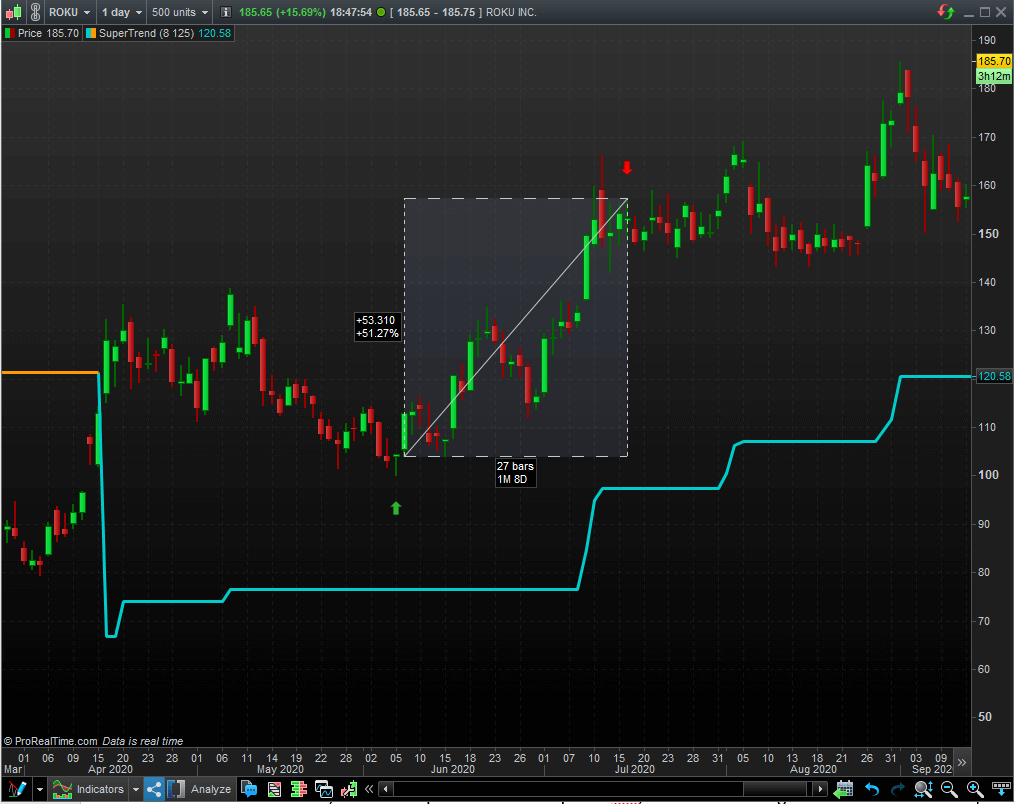

In the previous image, we can see the supertrend indicator displayed on the graph, using ProRealTime trading software. This indicator will help us identifying the trend direction. Let us suppose that today is the green arrow marked on the graph.

If we buy the shares and sell them where the red arrow is, we will get $53 per share of profit. In other words, we will have made approximately $1,500 profit, which is a great deal. But it can be improved even more with financial options.

Comparing the call option trading with the stock trading

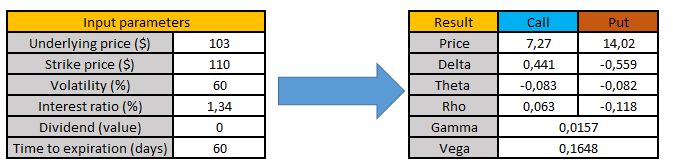

If instead of buying shares, we have decided to buy a call option, the situation will be different. Suppose we choose to buy the option with an expiration date of 60 days and a strike price of $110.

We will be buying the right to obtain 100 shares at $110, regardless of the current value of the stock for 60 days. Now, the question is… How much does it cost us to buy a call option for these characteristics?

The value of the call option, according to the Black Scholes model, would be $727 for each contract. That is to say, with the account we have, we will be able to buy up to 4 call option contracts that will allow us to control 400 Roku titles.

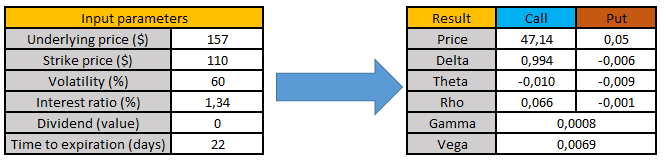

Now, when selling those call options, since we had obtained $53 per share after 38 days, let us take a look at how much we would have obtained according to the calculator…

The value of the call option has now increased from $727 to $4714 for each of the contracts. Since we bought four option contracts, the value of these is now $18856 in total. If we subtract what it cost us to buy each call option, the resulting value will be $15948 in net profit.

This exceeds any stock trade!

If you want to check it, you can easily download our free option trading calculator along with the Options Guide here:

Many people believe that buying calls is like gambling in the option market. If you want to know our opinion, here we have an article in which we detail everything we need to know.

When are call options exercised?

In the example above, what we have done is buy a call option and then sell it.

We did this because we did not want to keep any share in our portfolio, we simply wanted to profit on our trade.

However, if what we want is to keep the shares, we will be able to exercise our call options and obtain our right to get the 100 shares of each of the contracts. However, to exercise our rights, we will have to take into account a couple of things.

We want to exercise our Roku options and keep the 400 shares in our portfolio. Since we have paid $727 for each of the contracts, we will have to pay the value of the stock at the strike price.

That is, we will have to pay to the seller of the option the $110 for each of the shares. Again, this is independent of the current share price.

In our case, we should collect $44,000 to buy the securities and keep them in our portfolio. As you can see, this can be quite expensive, so on many occasions, it is better to sell the options as they are.

How are call options exercised?

If we still want to exercise our call option, all we have to do is notify the broker that we want to exercise our rights.

Typically, all the option brokers will allow us this possibility, but we must be careful, because some will charge us quite a lot of fees for exercising an option.

If you want to know more, here we discuss what happens if a call doesn’t reach strike price at expiration date.

Why buy call options then?

Mainly, we should buy a call option because of the extraordinary leverage it provides us. If we have a small account to trade in the market, buying calls will allow us to trade with excellent returns.

Also, we will have an excellent risk control, since we can only lose, at most, the money we pay to buy the call option.

When to sell a call option?

As the writer of a call option, a trader is not shorting a stock as many stock traders believe. When we are selling a call option, we will be taking the opposite position from the one we have when buying a call option.

When we become the writers of a call option, we will be acquiring both a neutral and bearish position in the option market. This may sound a little confusing, but let us take a look at what this is using the same example.

Example of selling a call option

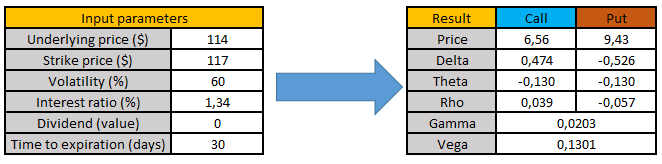

Roku stock price today is at $114. Since we believe that prices are NOT going to rise over the next few days, what we will do is to become writers of a call option at the strike price of $117 and for one month.

Let us check the value of our calculator to try to understand what is happening here.

In this case, if we decide to be the writer of a call option, we will make an immediate profit of $656 for each of the contracts we decide to sell.

This money that we receive will be ours, no matter what happens, and is the equivalent of what the buyer of the call option pays us for his right to obtain the share at $117, which is the strike price.

This means that as long as the share price does not rise above $117, we will have a winning position. However, if the price starts to rise above that particular threshold, we will get a loss equal to the difference between the stock price and the strike price.

The good news is that we will be able to select the strike price at which we want to sell the call option, so we have full and absolute control over the risk threshold we face.

As you can see, buying or being the writer of a call option are two sides of the same coin.

Why sell a call option then?

The reason is simple: we will be able to select a strike price at which we are certain the stock will not reach.

Done properly, selling this type of options is a great choice if we already have some stocks in our portfolio. If you want to deepen more about that, take a look at the covered call option strategy here.

Besides, we will win the trade if the market does not move or if it moves downwards. Very few strategies allow us to profit from two scenarios simultaneously, and this is a great advantage.

Other incentives will let us to get better returns from selling options, and that is time decay, which is explained here.