What happens if a call doesn’t reach strike price?

Another of the most frequent questions we may have when trading options is what happens if a call doesn’t reach strike price by expiration date, and the answer might depend on what side of the option call trade we are taking.

Let us take a deep look at what happens if a call doesn’t reach strike price for both buyers and sellers so we can have the complete picture.

Table of Contents

Defining the call option we will use as an example

Let us suppose we will be buying and then selling the same call option so you can easily understand what happens in each case.

We are going to assume that we will be trading a stock whose underlying price is $40 in the stock market and we will be focusing on the option contract whose strike price is $42 with an implied volatility of 30% and with 15 days to the expiration date.

Now that we have specified the option we will be treating, let us discover what happens if this call doesn’t reach strike price first as a buyer.

Discussing the situation for the option buyer

By buying a call option, we are going long or we are bullish in the market. However, taking into account that our strike price is $42, we expect the underlying stock to go beyond $42.3 at expiration or before, in order to make some profits.

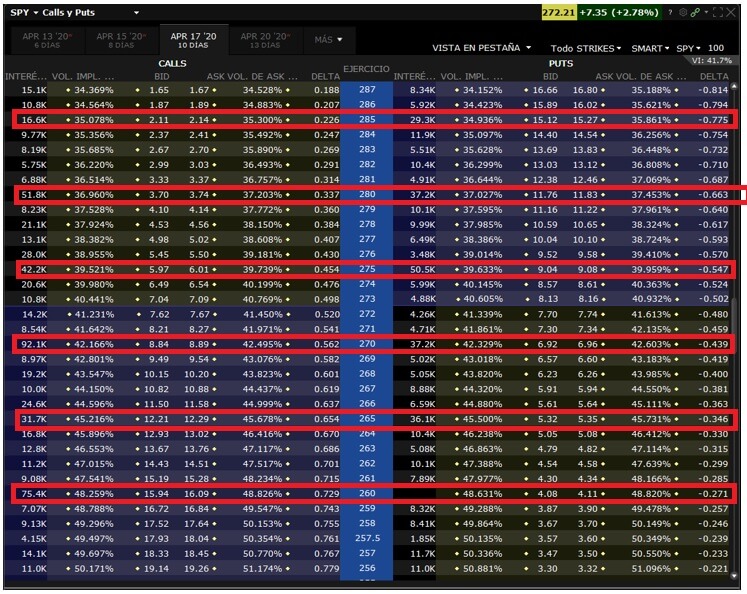

Why $42.3? Because when we open this trade, we are paying $30 as a premium. If we wanted to make any money, the underlying must surpass that threshold. Take a look at our Advanced Calculator in which we can see every key point and the P&L graph of the call option.

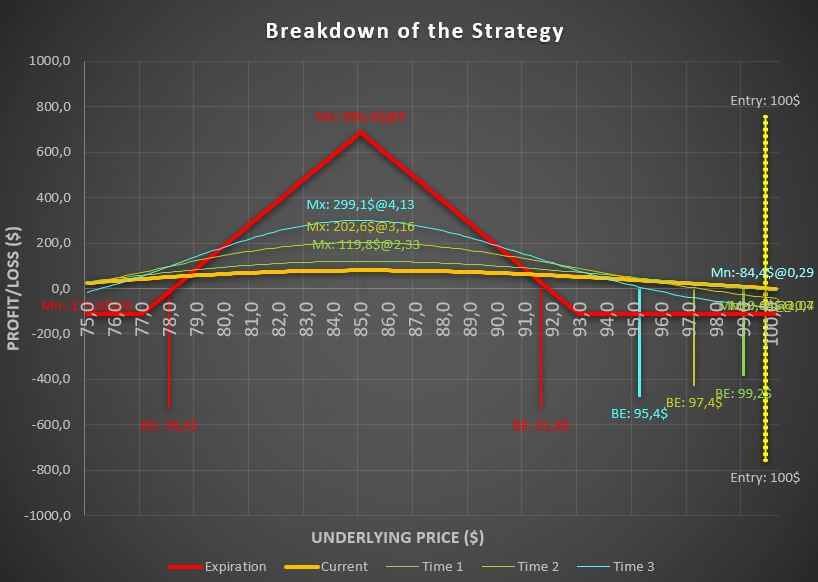

As you can see in the graph, we have two P&L curves, the orange one represent the current date (which is 15 days to expiration) and the red one represents the expiration date.

What happens if a call doesn’t reach strike price before expiration as a buyer?

If it was the case that the stock price begins to rise but does not reach the expiration date, depending on the days remaining, we could make some money.

Take a look at the following screenshot of the Advanced Calculator, in which we have supposed that the underlying price has reached $41 and $41.5 and different dates in time.

We paid $30 to buy the call option and as you can see, if the stock price rises, even without reaching our strike price, we could make money in many different situations, even when time decay affects our position.

So, in other words, it is possible to make money even when the call option does not reach the expiration date as buyers.

What happens if a call doesn’t reach strike price at expiration as a buyer?

When an option reaches the expiration date, it means that it has lost all its extrinsic value. Considering that, our option value will be zero and in those cases, the option contract will disappear from our portfolio at the following market open, incurring a loss.

The reason why our call option value is zero is because nobody would exercise an option whose strike price is larger than the current stock price.

Imagine the underlying price at expiration was $40. Why would you want to buy shares of a stock at the strike price of $42 when you could buy them in the stock market for less money? That is the reason why the value of our call option, in this case, is zero.

Discussing the situation for the option seller

By selling a call option, we are neutral and bearish in the market. In this case, we need to define better our metrics in order to understand where are our key points in the trade.

By selling the call option at the strike price of $42, we will be making money on the expiration day if the stock price does not rise above $42.30. As you can see, it is the exact opposite case compared to the buying example.

In this case, we will receive $30 for opening the trade, and we will keep them as long as the underlying price stays under $42.3 at the expiration date. Again, we have represented the P&L curves for both the expiration (red curve) and the current date (orange curve).

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

What happens if a call doesn’t reach strike price before expiration as a seller?

You may have noted in the orange curve that, if the underlying price gets closer to the strike price, we could be losing money before the expiration date. However, we must remember that selling an option benefits from time decay.

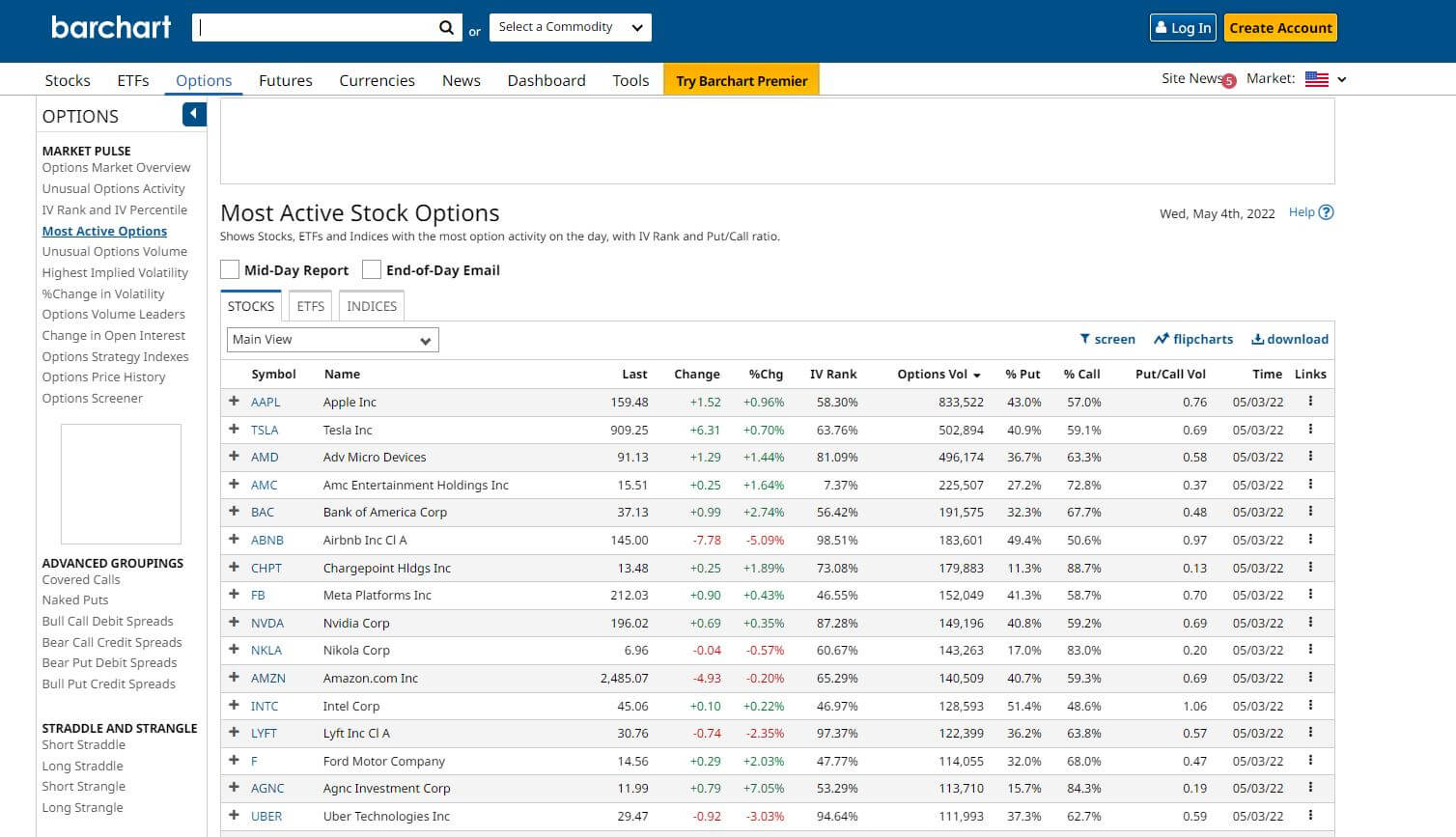

In other words, each day, our option will be making us a small profit. Take a look at the following screenshot where we have picked different underlying prices for varying expiration dates.

In this case, if the underlying price rises, the value of our option will increase thus making us lose money. However, when the option gets closer to its expiration date, this loss is even smaller, and in some cases, it is a profit.

What happens if a call doesn’t reach strike price at expiration as a seller?

If the underlying does not reach strike price at expiration, we will have won the trade, because the value of the option is zero. In this case, we keep the premium the buyer paid us and we can move on.

This is the best-case scenario for the option seller, of course.

Okay, but what happens if our call DOES reach the strike price at expiration as a seller?

In this case, the option buyer will exercise his option and we will have to provide 100 shares of the stock at the strike price we sold in our example, which was $42. Let us suppose that the underlying price rose to $45.

How big would have been our loss? Let us take a look at the screenshot of our Advanced Options Calculator…

In the left corner of the screenshot, we can see that the maximum loss is $270 (we have already subtracted the $30 premium we received when we opened the trade) reached at $45.

If the underlying had continued increasing, our losses would have been even larger.

However, keep in mind that the probability of this happening is very low. If you want solid probes about this, we highly recommend you to take a look at this article in which we discuss if options trading is the same that gambling.

Last words about what happens if a call doesn’t reach strike price

As we have discussed, the answer depends on the side of the trade we are taking. As a buyer, we always want the underlying to reach the strike price of our options, but that does not mean that we need that to happen in order to make profits.

As a seller, we always want the underlying price of the asset to NOT reach the strike price, as that could make us lose money. However, that is not probable as we may think.