What is strike price in options with examples?

To completely understand how options really work, we are going to answer to one of the most important questions: what is the meaning of strike price in options? What is strike price in options with examples?

We are going to provide also a few examples for put and call options to help you understand what the strike price is.

Table of Contents

What is the meaning of strike Price in options?

When we deal with options trading, we need to comprehend that there are three prices that we need to keep in mind: these are the underlying price, the premium and the strike price of the option.

As we saw in this article, the underlying price is the value of the stock or the commodity that we are trading, while the premium is the value of the option.

Now, what is the strike price in options? Depending on if we want to buy or sell, the meaning of the strike price can change.

What is the meaning of strike price in options for the buyer?

For the buyer, the strike price is the value at which the trader is entitled to buy some shares, regardless of the current price of the market.

Let us see some strike price in options examples to clarify this concept. We are going to suppose that we have a stock whose value today is $40.

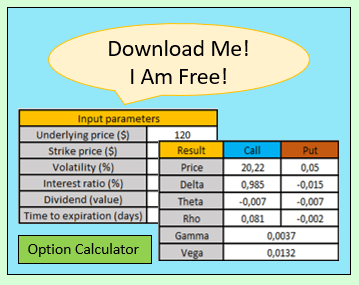

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Understanding what is the strike price on a put with examples as a buyer

Remember that, whenever we buy a put option, we are being short in the market.

That being said, if we decided to buy a put option whose strike price is $35, once we have paid the option premium, what that means is that we will be obtain 100 shares short of that stock at a price of $35, regardless of the price of the stock at that moment.

In other words, if we bought the $35 strike price, and the stock price at the expiration date of the option was $20, we would obtain -100 shares valued 35$ each.

In other words, we would obtain a profit of $15 per share, minus the option premium paid at the beginning of the trade. You can check this value in the following image.

Understanding what is the strike price on a call with examples as a buyer

Remember that, whenever we buy a call option, we are being long in the market.

That said, if we bought a call option whose strike price is $50, once that we have paid the premium, we are saying that we will obtain 100 shares long of that stock at a price of $50, regardless of the price of the stock at that moment.

In other words, if we bought the $50 strike price and the stock price at the expiration date was 70$, we would obtain 100 shares valued $50 each.

In other word, we would obtain a profit of $20 per shares minus the option premium paid at the beginning of the trade. Take a look at the following image.

What is strike price in options with examples for the seller?

For the seller, the strike price is the value at which the trader is entitled to receive some shares, regardless of the current price of the market.

Let us see some strike price in options examples to clarify this concept. Again, we are going to suppose that we have a stock whose value today is $40.

Understanding what is the strike price on a put as a seller

Remember, that whenever we sell a put option, we are being neutral and long in the market.

That said, if we sold a put option whose strike price is $35, after receiving some option premium, we are saying that we will provide the buyer of the option with -100 shares at a value of $35, regardless of the current stock market price at the expiration date.

In other words, if we sell the $35 strike price and the stock price at expiration date was at $20, we will have to provide to the option buyer with -100 shares of the stock at the value of $35.

That means that we would obtain 100 shares valued at $35, even when the market value today is at $20. So we have a loss total of $15 per share minus the option premium that we received when we opened the trade.

Take a look at the following image here to understand this better

Understanding what is strike price with examples on a call as a seller

Remember that when we sell a call, we are taking a neutral and bearish position in the market.

That being said, if we sold a call option whose strike price is $50, after receiving some option premium, what we are saying is that we will provide the buyer of the option with 100 shares at a value of $50, regardless of the current stock market price at the expiration.

In other words, if we sell the $50 strike price and the stock price at expiration was at $55, we will have to provide to the option buyer with 100 shares of the stock at the value of $50.

That means that we would get -100 shares valued at $50, even when the current price is $55. So, we would have a loss of $5 per share minus the premium obtained at the beginning of the trade.

Take a look at the following to understand this better.

Last words about what is the strike price in options with examples

As you can see, the strike price for the buyer is a very similar concept for both put and call options, while the same applies for the seller.

In any case, to fully understand what is strike price in options with examples, here you can take a look at a real option chain of the SPY ETF, one of the most important ETFs in the world.

There, you can see in the middle the strike prices of every option, and as you can see, we can either buy or sell call or put options.

In this article, we have learned what is the meaning of strike price in options. If you want to learn a little more about the different prices in options, we highly recommend you to take a look at this article here.