American Options and European Style Options – 2 Different Approaches

Many option traders, as they begin to understand how options work, they suppose that all options contracts are the same. American options and European options are two different styles when trading options, depending on the market one operates in.

Whether we are dealing with American options or European style options, the main differences lie when we want to exercise our rights to acquire the underlying stock.

In this article, we will review the American vs European options. We will take a look at what are European options and American options, how to price them, which are the main differences, and many more concepts.

Table of Contents

What are American options?

American style options are those options contracts that are typically traded in the United States and in many ETFs.

The particularity of this option is that we can exercise it whenever we want, and that is precisely the most significant difference between American and European options

How are American options priced?

The American options pricing model follows the Black Scholes option model to price both calls and puts.

If you need a free option trading Black Scholes calculator to help you trade, you can download ours for free here along with our free Options Guide:

How do American options work?

American style options work following the rules of the Black Scholes model.

If we are American options buyers, from the moment we decide to buy several option contracts, we can choose to exercise them to acquire 100 underlying stocks.

If we were American options sellers, if we have just sold a contract, the buyer could exercise his rights to obtain the shares, and we would have to provide him the underlying.

When can American options be exercised?

In both cases, as we are dealing with American style options, the assignment or exercise could be whenever the buyer desires. However, it is not very usual for the buyer to exercise before the expiration date arrives.

Why are American options more valuable?

Typically, we will find that American style options are more valuable than the European style options. The reason is that the American market has many more stocks with a higher value compared to the European market.

That makes that the American options pricing model following the Black Scholes formula to become a much higher premium for those options.

What are European options?

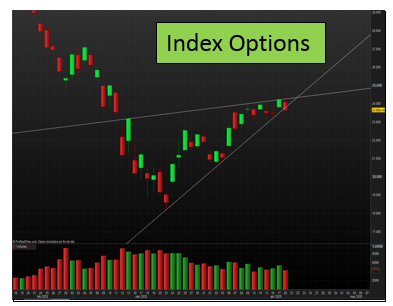

European style options are those options contracts that are typically traded outside the American market and in some stock index options.

The main difference of the European options is that we will not be able to exercise the contracts until the expiration date arrives, not before.

Do you need a Calculator that helps you create and analyze any option strategy in record time?

How are European options priced?

Pricing European options follows the same rules as pricing American options. In both cases, we will be using the Black Scholes model to price both calls and puts in both styles.

This calculator works for both american and european options, you can download it here

How do European options work?

European style options work following the rules of the Black Scholes model.

Let us suppose we are European options buyers. If we decide to buy several option contracts, we will not be able to exercise them until the expiration date arrives. However, we will be able to sell them if we want to.

If we were European options sellers, if we have just sold a contract, we are not going to face the risk of the buyer exercising his option, as it will not be possible until the expiration date arrives. Again, if we wanted to exit the trade, we will always be able to buy it.

When can European options be exercised?

In both cases, as we are dealing with European style options, the assignment or exercise is not allowed until the expiration date arrives. We will be able to sell or buy more contracts, just as the American style options allow.

American vs European options

As we have already seen, the most significant difference between American and European options lies in the capability of exercising the option.

With American style options, we will be able to buy, sell, and exercise whenever we want.

With European style options, we will be able to buy and sell whenever we want. However, it is not allowed to exercise the option until the expiration date arrives.

The rest of the concepts, option moneyness, buying calls and puts, the implied volatility… are perfectly valid in both American and European options, except for exercising the contracts.

Then, which style is better: American style options or European style options?

This difference is not positive or negative. It is merely one more factor that must be taken into account when performing operations on both sides of the world. On the other hand, it should be mentioned that the liquidity of the European style options market is not as high as one would expect.

Usually, if we want to look for operations that generally have a high volume of contracts, we will have to go to some specific options, as could be the stock index options.

Therefore, for a trader who is just starting out, the best and easiest thing to do would be trade with American style options. However, the trader should be aware that not every option chain is as liquid as it may seem. After all, we have to deal with exercise prices and different expiration dates for each of the companies. And of course, not all companies have options contracts.

Usually, those that do allow working with options typically have a higher volume of transactions in the stock market.

In any case, the US market, in terms of stock options, is much more liquid than the European market. If you intend to practice option trading, we recommend starting with the American options.

However, we have to consider that, if we want to trade with stock index options, many of them have the European style.