Beginner’s Guide: How to Invest in the Stock Market

Investing in the stock market can be a rewarding way to grow your wealth. In this article, we’ll explore the basics of investing in stocks, from setting investment goals and understanding risk tolerance to buying and selling stocks, analyzing company fundamentals, and managing risks through diversification.

We’ll also cover key concepts such as dividends, capital gains, and different investing strategies. Additionally, we’ll answer frequently asked questions regarding starting capital, common mistakes to avoid, staying informed about market trends, and tax implications.

Let’s dive into the world of stock market investing!

Getting Started with Stock Market Investments

Before diving into the world of stock market investing, it’s important to establish clear investment goals. This helps provide direction and clarity for your investment strategy. Consider what you hope to achieve through your investments, whether it’s long-term wealth accumulation, funding your retirement, or achieving specific financial milestones.

By identifying your investment goals, you can tailor your approach accordingly.

Setting Investment Goals

Set specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, if your goal is to save for retirement, determine how much money you’ll need and by what age you want to retire.

Having a clear target will help you determine the amount of risk you’re comfortable with and establish appropriate steps towards achieving your goals.

Understanding Risk Tolerance

Assess your risk tolerance, which refers to your ability and willingness to endure potential investment losses. Determine how much volatility you can handle and how it aligns with your investment goals and time horizon.

Conservative investors may prefer lower-risk investments, while more aggressive individuals may be willing to take on higher risks for potential higher returns.

Building an Investment Portfolio

Consider investing in a mix of stocks, bonds, mutual funds, and other assets that align with your risk tolerance and investment goals.

Choosing a Brokerage Account

Selecting a brokerage account is a crucial step in getting started with stock market investments. Look for reputable brokerage firms that offer a user-friendly interface, robust research tools, educational resources, and competitive trading fees.

Consider factors such as customer support, account types, and the availability of investment options that align with your investment interests.

How to Buy and Sell Stocks

In the world of stock market investing, buying and selling stocks is a crucial aspect. By understanding the different types of orders and trading options available, investors can make informed decisions to maximize their investments.

Let’s explore the key concepts related to buying and selling stocks.

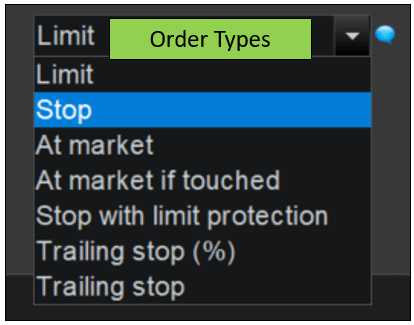

Types of Orders and Trading Options

When it comes to executing stock trades, investors have various options. Understanding these options is essential for effective trading. Here are some common types of orders and trading options:

- Market Orders: With a market order, you purchase or sell a stock at the current market price.

This type of order ensures fast execution but may not guarantee a specific price.

- Limit Orders: A limit order lets you set a specific price at which you are willing to buy or sell a stock.

The order will only be executed if the stock reaches the set price or better.

- Stop Orders: Stop orders are used to limit potential losses or protect gains. A stop-loss order sets a specific price at which you are willing to sell to prevent further losses.

A stop-limit order combines a stop order and a limit order, allowing you to set both a stop price and a limit price.

Understanding Market Orders and Limit Orders

Market orders and limit orders are two primary types of orders used in stock market transactions.

Market orders prioritize speed of execution and guarantee that your order will be executed promptly. However, they do not guarantee a specific price. On the other hand, limit orders allow you to set a specific price at which you want to buy or sell a stock.

This type of order provides more control over the execution price but may not be executed if the market does not reach the desired price.

Placing a Stock Trade

Placing a stock trade involves a series of steps that ensure your orders are executed correctly. Firstly, you need to have a brokerage account where you can buy and sell stocks.

Once you have chosen a brokerage, you can use their online trading platform or contact a broker directly to place your trades. When placing a trade, you need to specify the stock symbol, the number of shares you want to buy or sell, the type of order, and any additional conditions or instructions.

Always double-check your order details before submitting to ensure accuracy.

By understanding the different types of orders and trading options, as well as the process of placing a stock trade, investors can navigate the stock market effectively and make informed decisions.

Factors to Consider in Stock Market Investing

When it comes to investing in the stock market, there are several factors that you need to consider in order to make informed decisions. These factors include analyzing company fundamentals, evaluating industry trends and market conditions, and researching and selecting stocks.

Analyzing Company Fundamentals

One important aspect of stock market investing is analyzing the fundamentals of the companies you are interested in. This involves examining their financial statements, such as the balance sheet, income statement, and cash flow statement, to assess their financial health and performance.

By looking at key metrics like revenue growth, profit margins, and debt levels, you can gain insights into the company’s stability and potential for growth.

Evaluating Industry Trends and Market Conditions

Understanding industry trends and market conditions is crucial for successful stock market investing. You should keep an eye on the performance of the industry in which the company operates and assess its growth prospects.

Factors such as technological advancements, regulatory changes, and competition can significantly impact the industry and, consequently, the performance of the companies. Additionally, staying informed about the overall market conditions, such as economic indicators and market trends, can help you make better investment decisions.

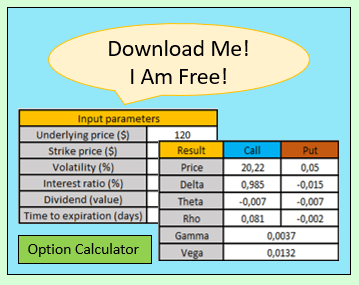

Do you need a Calculator that helps you create and analyze any option strategy in record time?

Researching and Selecting Stocks

Researching and selecting stocks requires a thorough analysis of various factors. This includes evaluating the company’s competitive advantage, management team, products or services, and growth potential. It is essential to consider both quantitative factors, such as financial ratios and historical performance, as well as qualitative factors, such as industry positioning and future growth prospects.

By conducting detailed research and due diligence, you can identify stocks that align with your investment goals and have the potential to generate favorable returns.

Managing Risks and Diversification

Managing risks and diversifying your investment portfolio are crucial aspects of successful stock market investing. By spreading your investments across various asset classes and sectors, you reduce the impact of any single investment’s performance on your overall portfolio.

Importance of Diversification

Diversification is the practice of investing in different types of assets, such as stocks, bonds, commodities, and real estate, to minimize the risk of losing all your investment due to a single event or poor performance of a particular asset class.

By diversifying, you can achieve a balance between potentially higher returns and lower risks. Different asset classes tend to perform differently under various market conditions, so spreading your investments can help offset losses in one area with gains in another.

Diversification can be achieved on multiple levels. Besides investing in different asset classes, you can diversify within each asset class by investing in various industries and sectors. It’s also essential to consider the market capitalization of the companies you invest in, as large-cap, mid-cap, and small-cap stocks might perform differently in different market conditions.

Do you need a fast Stock Trading Journal that helps you make better decisions?

In this short video, we will show you how to know in detail the results of your trading, how to get an estimate of the number of stocks to trade based on risk, and how to drastically reduce the time it takes to record your trades with this Journal

Strategies to Manage Investment Risks

Implementing effective risk management strategies can help protect your investment portfolio from significant downturns in the market. Here are some strategies to consider:

- Asset allocation: Determine the right mix of asset classes based on your investment goals, time horizon, and risk tolerance.

Adjust your allocation as market conditions and your financial circumstances change.

- Stop-loss orders: Consider setting stop-loss orders to automatically sell a stock if it reaches a predetermined price. This helps limit potential losses by activating a sell order when the stock price falls.

- Research and analysis: Thoroughly research and analyze companies before investing.

Understand their financial health, competitive advantage, and growth potential. This reduces the risk of investing in companies with uncertain prospects.

Balancing a Portfolio for Long-term Growth

As an investor, it’s important to balance your portfolio for long-term growth and align it with your financial goals. Here are some points to consider:

- Rebalance regularly: Periodically review your portfolio and rebalance it to maintain your desired asset allocation.

Selling overperforming assets and buying underperforming ones helps bring your portfolio back to its intended balance.

- Stay disciplined: Emotional decision-making can lead to poor investment choices. Stick to your investment plan and avoid making impulsive decisions based on short-term market fluctuations.

- Consider professional advice: If needed, consult with a financial advisor who can provide expert guidance on managing your portfolio based on your specific circumstances and goals.

Key Concepts in Stock Market Investing

In this section, we will explore some key concepts that are crucial to understand when investing in the stock market.

These concepts include dividends and capital gains, fundamental and technical analysis, as well as long-term and short-term investing strategies.

Understanding Dividends and Capital Gains

Dividends and capital gains are two essential components of stock market investing. Dividends represent the portion of a company’s profits distributed to its shareholders. They are typically paid out quarterly or annually and can provide a steady income stream to investors.

On the other hand, capital gains refer to the increase in the value of an investment over time. They are realized when a stock is sold at a higher price than its purchase price, resulting in a profit for the investor.

Basics of Fundamental and Technical Analysis

When it comes to analyzing stocks, investors often rely on both fundamental and technical analysis. Fundamental analysis involves evaluating a company’s financial health, such as its revenue, earnings, debt levels, and competitive position.

It helps investors assess the intrinsic value of a stock and make informed investment decisions. On the other hand, technical analysis focuses on studying stock price patterns and trends using various tools and indicators.

It aims to predict future price movements based on historical data and market trends.

Long-Term vs. Short-Term Investing Strategies

Investors can adopt different strategies based on their investment goals and time horizon. Long-term investing involves buying and holding stocks for an extended period, usually several years or more. This strategy aims to capitalize on the potential growth of companies over time and minimize the impact of short-term market fluctuations.

Short-term investing, on the other hand, focuses on taking advantage of short-lived market opportunities and capitalizing on price volatility. Traders who implement short-term strategies often engage in frequent buying and selling of stocks to generate profits.

- Key concepts covered in this section:

- Dividends and capital gains

- Fundamental analysis

- Technical analysis

- Long-term investing

- Short-term investing

Understanding these key concepts is crucial for anyone looking to venture into stock market investing.

By grasping the concepts of dividends and capital gains, fundamental and technical analysis, as well as long-term and short-term strategies, investors can make more informed decisions and navigate the complexities of the stock market effectively.

FAQs about Investing in the Stock Market

How much money do I need to start investing?

To start investing in the stock market, the amount of money you need depends on your financial goals and risk tolerance. While some people may choose to start with a small amount, such as a few hundred dollars, it is generally recommended to have at least a few thousand dollars to diversify your portfolio and have a meaningful impact.

However, it’s important to remember that investing in stocks carries risks, and you should only invest what you can afford to lose.

What are common mistakes to avoid in stock market investing?

When investing in the stock market, there are some common mistakes that you should avoid to maximize your chances of success. These include:

- Trying to time the market: It’s challenging to predict short-term market movements, so it’s generally advisable to focus on long-term investing.

- Putting all your eggs in one basket: Diversification is key to reduce risk.

Investing in a variety of stocks across different sectors can help protect your investments.

- Letting emotions drive your investment decisions: Making impulsive decisions based on fear or greed can lead to poor results.

It’s important to stay disciplined and stick to your investment strategy.

- Neglecting to do research: Before investing in a stock, it’s crucial to research the company’s financials, performance, and industry trends to make informed decisions.

- Ignoring long-term goals: It’s important to have a clear investment plan and stick to it, focusing on your long-term objectives rather than short-term fluctuations.

How can I stay informed about market trends and company news?

Staying informed about market trends and company news is crucial for successful investing.

Here are some ways to stay up to date:

- Follow financial news: Regularly read reputable financial news sources to stay informed about the latest market trends, economic indicators, and company developments.

- Use stock market analysis tools: Utilize online platforms and tools that provide real-time stock quotes, charts, and analysis to track market movements and evaluate potential investment opportunities.

- Join investment communities: Participate in investment forums, online communities, and social media groups focused on investing to learn from others and discuss market trends.

- Research company reports and earnings releases: Review quarterly and annual reports, as well as earnings releases, to gain insights into a company’s financial performance and future prospects.

What are the tax implications of stock market investing?

When it comes to stock market investing, it’s essential to consider the tax implications.

Here are some key points to keep in mind:

- Capital gains tax: Profits from selling stocks held for more than a year are usually subject to long-term capital gains tax, while profits from stocks held for less than a year are classified as short-term capital gains and taxed at a higher rate.

- Dividend tax: Dividends received from stocks are generally subject to income tax, either at ordinary income tax rates or at lower rates for qualified dividends.

- Tax-efficient investing: Consider tax-efficient investing strategies, such as holding stocks in tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k) plans, to minimize the impact of taxes on your returns.

- Consult a tax professional: Tax laws can be complex, so it’s advisable to consult a qualified tax professional who can provide personalized advice based on your individual circumstances.

.

…