What is Stock Trading Volume: Understanding the Basics in the US

Understanding Stock Trading Volume is vital in the world of investing. It represents the number of shares or contracts traded within a specific time period. High volume indicates increased investor interest, potentially leading to significant price movements.

Conversely, low volume suggests lack of interest or investor apathy, resulting in limited price changes. Liquidity and technical analysis also rely on volume. When making investment decisions, volume should be considered alongside other factors, such as business models and price-to-earnings ratios.

Let’s explore the role of stock trading volume in the US market.

Understanding Stock Trading Volume

Stock trading volume refers to the measure of activity and participation of investors in the market. It represents the number of transactions that occur within a specific period of time, and it can vary significantly from one stock to another and from one day to another.

What is Stock Trading Volume?

Stock trading volume is a crucial metric that quantifies the number of shares or contracts traded in a given time frame. It provides insight into the level of interest and engagement of investors in a particular stock or the overall market.

Importance of Stock Trading Volume

Understanding stock trading volume is essential for several reasons. Firstly, it can indicate the level of investor interest and participation in a stock. Higher trading volume suggests increased market activity and potential price movements.

Conversely, lower trading volume may indicate diminished interest or investor apathy, resulting in limited price changes.

Secondly, stock trading volume provides insights into the liquidity of a stock. Stocks with higher trading volume typically have better liquidity, allowing for easier buying and selling of shares.

Lastly, volume plays a significant role in technical analysis. By analyzing stock trading volume, a trader or investor can gauge the strength of price movements and potentially identify trends or patterns that may lead to profitable trading opportunities.

In conclusion, understanding stock trading volume is crucial for investors in the US market. It provides insights into investor interest, liquidity, and can aid in technical analysis. By considering the volume alongside other factors, investors can make informed investment decisions for both short-term trading and long-term investing.

Factors that Affect Stock Trading Volume

Stock trading volume is influenced by various factors that reflect investor behavior and market dynamics. This section explores two key factors that significantly impact the volume of stock trading: investor interest and participation, and market events and news impact.

Investor Interest and Participation

Investor interest and active participation play a crucial role in determining stock trading volume. When investors perceive a particular stock or market as potentially profitable, their interest in buying or selling increases, resulting in higher trading volume.

Factors such as earnings reports, market trends, and economic indicators can generate increased investor interest and boost trading volume. Conversely, lackluster investor sentiment can lead to lower volume as participants hold back from trading.

Market Events and News Impact

Market events and news can have a significant impact on stock trading volume. Major announcements, such as corporate earnings releases, mergers and acquisitions, regulatory changes, or geopolitical developments, often trigger fluctuations in trading volume.

Positive news can generate increased trading activity as investors respond to favorable developments, while negative news can spark heightened selling activity and higher volume. Additionally, market-wide events, such as economic crises or policy shifts, can create volatility and influence trading volume across multiple securities.

Summary

- Investor interest and participation greatly influence stock trading volume.

- Positive market events and news can lead to increased trading volume, reflecting investor response to favorable developments.

- Negative news or market events can result in heightened selling activity and higher trading volume.

Understanding these factors is crucial in comprehending the dynamics of stock trading volume and its implications for market trends and investor behavior.

When analyzing stock trading volume, there are two key aspects to consider: the liquidity of stocks and the use of volume as an indicator in technical analysis.

Liquidity refers to the ease with which a stock can be converted to cash. Stocks with higher volume tend to have better liquidity, as more investors are actively buying and selling shares.

This liquidity provides traders with the ability to enter and exit positions quickly without significantly affecting the stock’s price.

Investors often prefer stocks with good liquidity, as it allows them to respond swiftly to market conditions or news events. Additionally, stocks with higher liquidity generally have tighter bid-ask spreads, reducing transaction costs for investors.

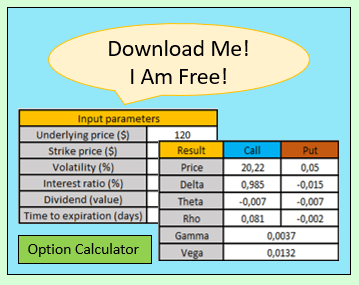

Do you need a Calculator that helps you create and analyze any option strategy in record time?

Volume as an Indicator in Technical Analysis

Volume is a crucial component in technical analysis, which involves studying historical price and volume patterns to predict future price movements. Volume can provide insights into the strength of price trends and potential reversals.

Volume Confirmation:

In technical analysis, when an increase in price is accompanied by a substantial increase in volume, it is considered a confirmation of the price movement. This suggests that the trend is likely to continue, as it is supported by higher market participation.

Volume Divergence:

On the other hand, if the price is rising, but volume is decreasing, it may indicate a potential reversal or weakening of the trend.

This divergence between price and volume suggests that the market sentiment may be changing.

Volume Breakouts:

Breakouts occur when a stock’s price surpasses a significant resistance or support level, accompanied by a surge in volume. This suggests a strong shift in market sentiment and can signal the start of a new trend.

By analyzing volume patterns in conjunction with price movements, technical analysts can gain valuable insights into the strength and sustainability of market trends.

Remember, while analyzing stock trading volume is vital, it should be combined with other analyses, such as fundamental analysis and consideration of other market factors, to make well-informed investment decisions.

Incorporating Stock Trading Volume in Investment Decisions

When making investment decisions, it is imperative to consider multiple factors in the analysis. Stock trading volume plays a significant role in understanding market dynamics and can provide valuable insights alongside other indicators.

Here, we explore how volume can be used in conjunction with other indicators to make informed investment choices.

Considering Multiple Factors in Investment Analysis

Investors should not rely solely on stock trading volume when making decisions. It is crucial to consider other essential factors like the company’s business model, financial performance, and industry trends.

By analyzing these factors collectively, investors can gain a comprehensive understanding of the investment opportunity and make more informed decisions.

Using Volume in Conjunction with Other Indicators

Volume is a powerful tool when used in combination with other indicators. Technical analysis incorporates various indicators like moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence). By evaluating stock trading volume alongside these indicators, investors can identify potential entry and exit points, gauge the strength of price movements, and validate their trading decisions.

- Consider the stock’s price trend: Analyze the relationship between stock price movements and trading volume. Higher volumes during upward price trends may indicate bullish sentiment, while lower volumes during downward trends may suggest bearish sentiment.

- Identify divergences: Compare the volume trends with other indicators, such as oscillators or trend lines.

Divergence between volume and price can provide insightful clues about potential reversals or continuation patterns.

- Confirm breakout or breakdown: Volume can help confirm the validity of a breakout or breakdown. Higher volumes accompanying a breakout or breakdown increase the confidence in the validity of the price movement.

By incorporating stock trading volume with other indicators, investors can improve their understanding of market dynamics, identify potential trading opportunities, and reduce the risk of false signals.

The Role of Stock Trading Volume in Short-term Trading and Long-term Investing

Stock trading volume plays a crucial role in both short-term trading and long-term investing strategies. Understanding how volume impacts these approaches can help investors make informed decisions. Let’s explore two key aspects of utilizing volume in these contexts: short-term profit generation and long-term focus on company growth.

Utilizing Volume for Short-term Profit Generation

Short-term traders often rely on stock trading volume to identify potential profit opportunities within a specific timeframe. By analyzing volume patterns alongside price movements, traders aim to capitalize on short-term price fluctuations.

When volume surges significantly higher than average, it can suggest increased investor interest and participation. This surge may be triggered by events like earnings announcements, product launches, or breaking news.

Traders interpret these volume spikes as potential signals for short-term price movements.

By closely monitoring volume and price action, traders can identify trends, spot entry and exit points, and execute quick trades to take advantage of short-term market fluctuations. For example, a sudden surge in volume accompanied by a rapid increase in price may indicate bullish momentum, prompting traders to enter positions and aim for quick profits as the price rises.

Long-term Focus on Company Growth

While short-term traders primarily concentrate on immediate profit opportunities, long-term investors take a different approach. Instead of solely relying on short-term price movements driven by volume spikes, they focus on the underlying fundamentals and long-term growth prospects of a company.

For long-term investors, stock trading volume serves as a valuable indicator of market liquidity and investor confidence. High trading volume in a stock over an extended period can indicate strong market interest and a liquid market for buying or selling shares.

This liquidity is important for long-term investors who seek stability and the ability to enter or exit positions as needed.

Do you need a fast Stock Trading Journal that helps you make better decisions?

In this short video, we will show you how to know in detail the results of your trading, how to get an estimate of the number of stocks to trade based on risk, and how to drastically reduce the time it takes to record your trades with this Journal

By considering both volume and other fundamental analysis factors like a company’s financial health, market position, and competitive advantages, long-term investors can make informed decisions about portfolio allocation and identify stocks with the potential for sustainable growth over time.

Overall, stock trading volume plays a crucial role in both short-term trading strategies focused on quick profit generation and long-term investments aiming for sustained growth. While short-term traders rely on volume spikes for timely market entries and exits, long-term investors consider volume as part of a comprehensive analysis to identify companies with long-term growth potential.

….