What is a Short Straddle Option Strategy?

Of the different option strategies that we can use in the option market, the short straddle option strategy is one that we can use to make money whenever we expect that the underlying price is going to stay where it is for the following days.

Even when this strategy may seem appealing, we really need to treat it carefully as it can really damage our account.

In this article, we are going to be learning what is a short straddle option strategy, we will show you some examples using our advanced option strategy builder Excel and we will compare this strategy to its long counterpart, the long straddle.

Table of Contents

What is a short straddle option strategy?

The short straddle option strategy is a neutral selling strategy that is formed by two At The Money options, one being a call and another one being a put option.

Ideally, we want to be opening the short straddle option strategy whenever the underlying price is as close as possible to the underlying price, maintaining the neutrality as much as we can.

Let us take a look at a short straddle option strategy example so we can understand it better.

Short straddle option strategy example

In this case, we are going to be using the underlying price of Starbucks stock. Let us now suppose we believe that instead of a strong movement in the market, just like we saw in the long straddle option strategy, in this trade we expect the price to stay flat.

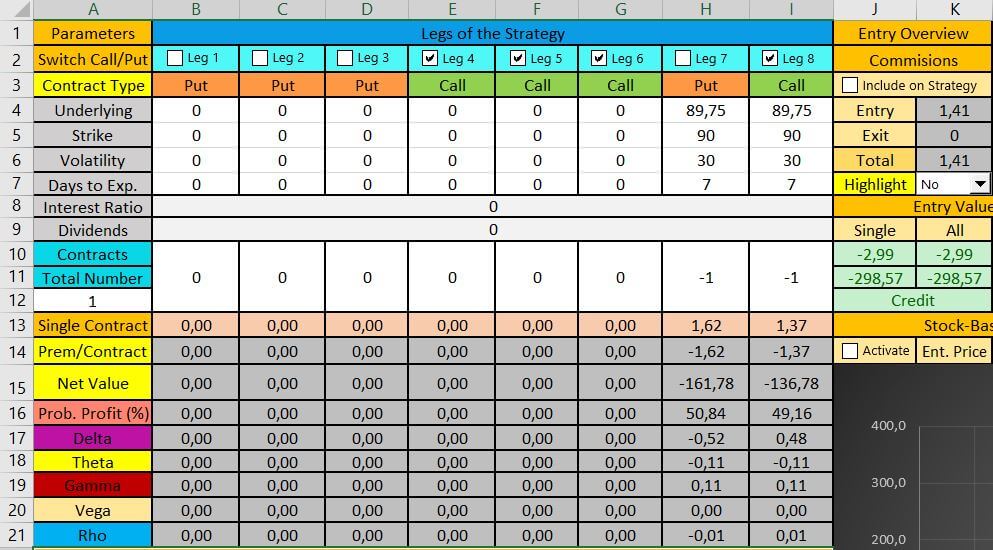

To take advantage of that assumption, we are going to be opening a short straddle option strategy with a strike price of $90. As it is very difficult to get the exact underlying price, we will pick the closer one to the current stock price.

Short strangle option strategy: At The Money Call and Put Options

Taking the exact same strike price, when we open this option strategy, we will receive $2.99 instead of paying them. So, for our strategy to fail, the stock price should rise above $93 or fall below the $87 threshold.

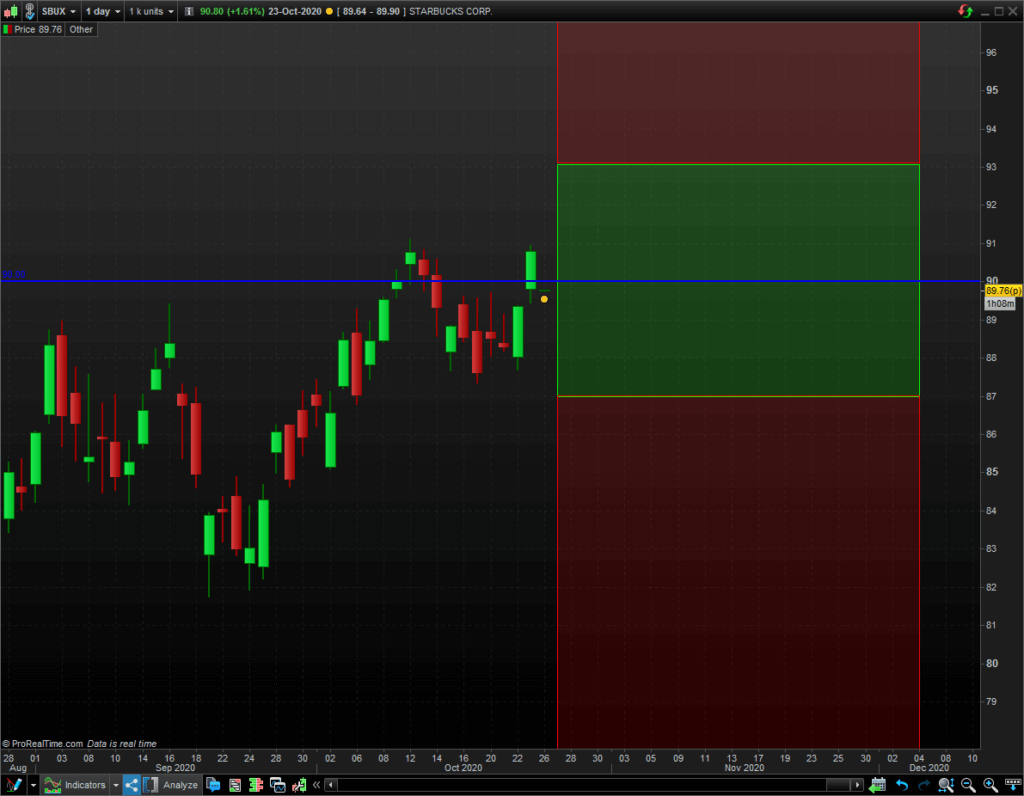

In the following image, you can take a look at how would the short strangle option strategy perform when we overlap the areas over the stock chart given by ProRealTime trading.

Here we can check the areas of interest of the short straddle option strategy

It is exactly the opposite situation we found in the long straddle option strategy.

For this example, the red, which is the area where our short straddle will losse money, is found above $93, and under the $87 threshold, while we will keep the premium the buyer paid us if the stock price remains in the green area.

However, we must keep in mind that, in the red area, the risk is unlimited, as the price could fall or rise much more, however, that is a very unlikely scenario.

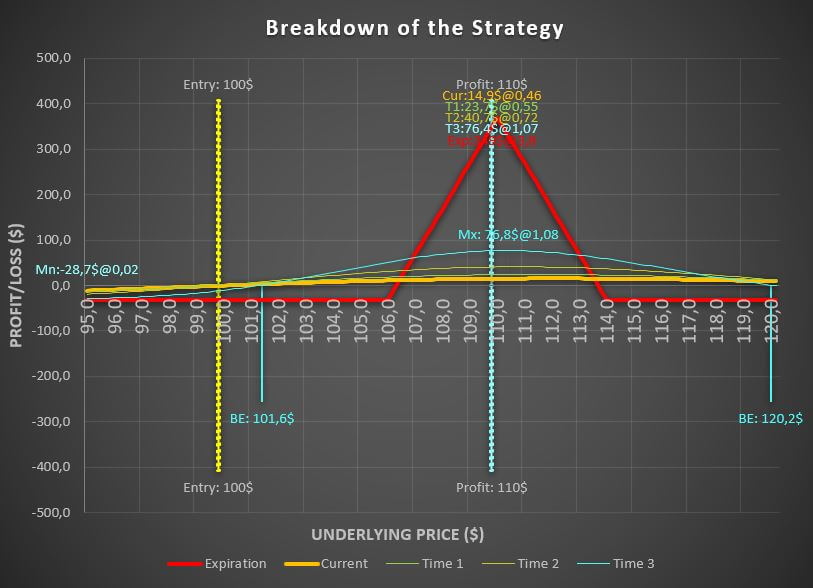

Short straddle option strategy payoff diagram

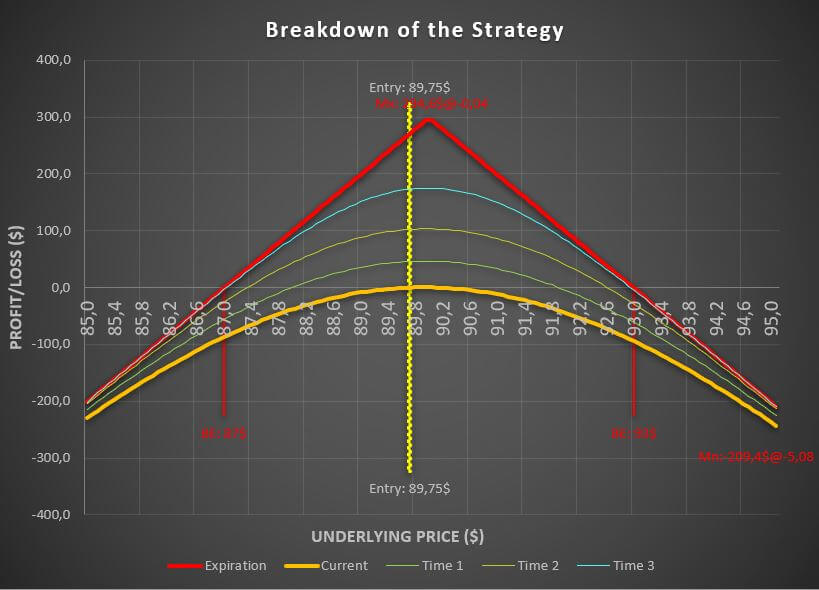

To understand a little better how our short straddle option strategy works, the best thing to do is to graph the performance of the strategy with our option strategy calculator in excel

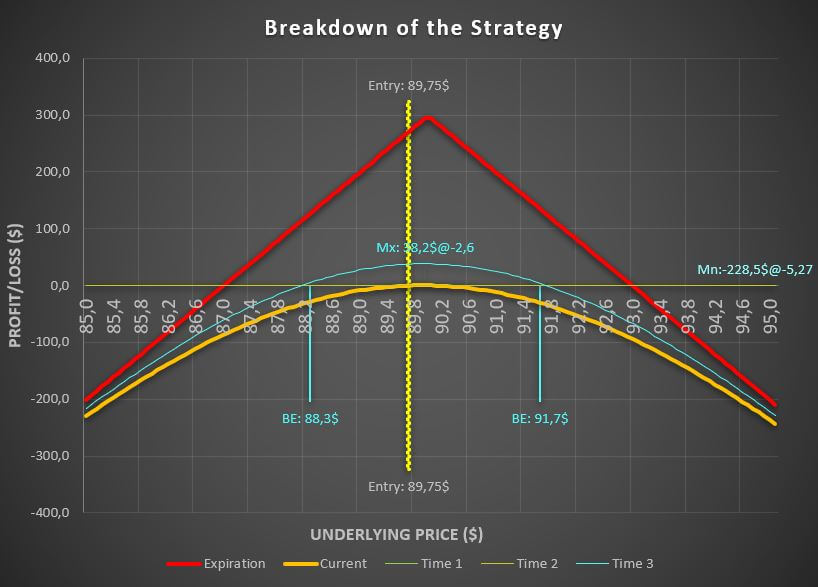

Short straddle option strategy payoff diagram

As you can see, the short straddle option strategy payoff diagram is exactly the opposite we found with the long straddle strategy. In this case, time decay benefits our trade as we are dealing with At The Money options.

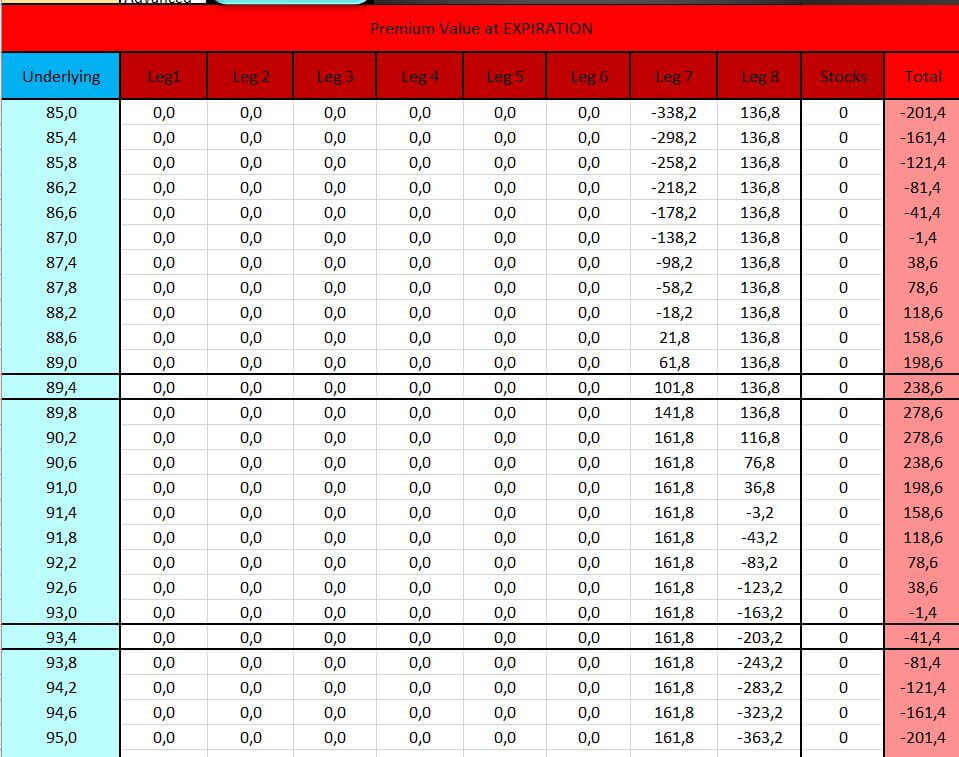

In the previous table, we can check the exact values we could expect at the expiration date.

How would the volatility affect the short straddle option strategy?

Even when this strategy might seems quite risky, the probabilities of the short straddle entering the red area are low.

However, we need to keep in mind that volatility plays a very important role in this case, because we are profiting mainly from the extrinsic value of the At The Money call and put options.

We are going to be analyzing how the volatility affects the trade once we have already open the short straddle.

First scenario of the short straddle option strategy example: volatility rises

The volatility of the stock will rise whenever the stock price moves. That being said, if we are already in the trade, a strong movement in volatility could damage our position very badly.

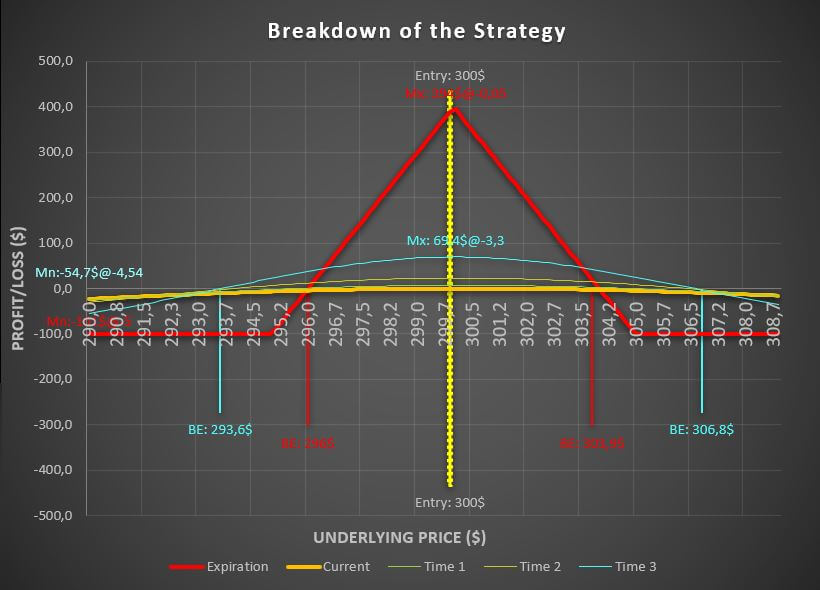

Let us suppose that the volatility have risen from 30% to 40% in the following three days. Take a look at the following payoff diagram.

Take a look at the blue curve which is set when there are still 4 days to expiration and the volatility has risen

As we can see, even when the volatility rises, the time decay manages to reduce the loses that we have accumulated. But of course, we need to be careful, because when the volatility goes up, it is more probable that the price begins to move faster too.

Second scenario of the short straddle option strategy example: volatility goes down

This is the best possible scenario for the short straddle, because a lower volatility means that the premium of the options will be reduced and the stock is more likely to stay flat.

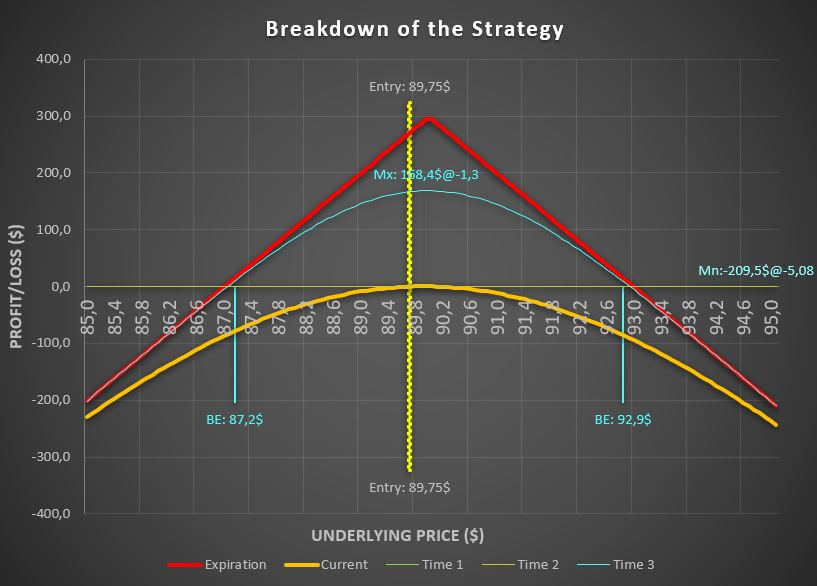

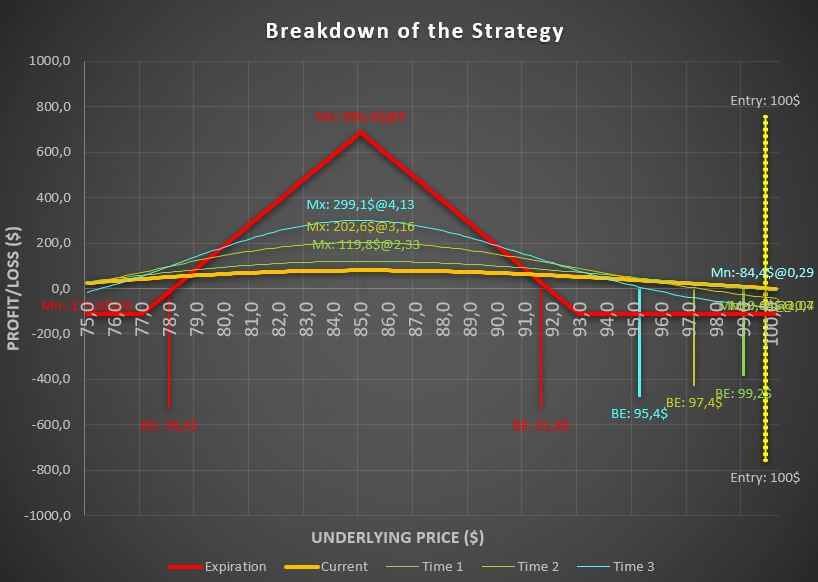

Let us suppose that the volatility has fallen from 30% to 20% in the following three days. Let us take a look at the diagram.

The blue curve represents again the 4 days to expiration and the volatility changes

As we can see, the premium we would have to pay to close the short straddle option strategy is quite low, which is a very good thing.

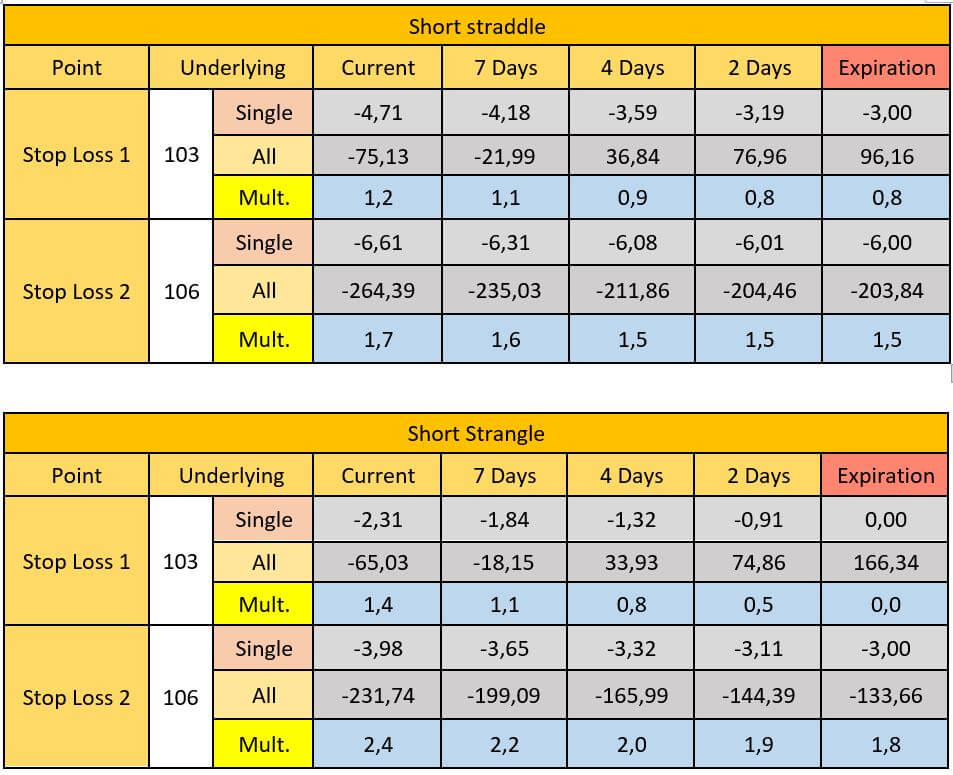

Conclusions of the study

The short straddle strategy will perform better when we open it in a high volatility environment, and while we are in the trade, that same volatility fades away.

However, if the volatility ends up rising, the strategy might damage our account with a higher probability.

Short straddle option strategy margin requirement

In this case, as we are shorting At The Money contracts, our broker will ask us quite a lot of money to let us open the trade. The reason is we must provide insurance that, in the case, we end up assigned, we can pay the buyer the money we have to.

To open this kind of strategy, we are going to need to have a margin account.

Even when it is not very probable that any of the branches of the strategy ends up assigned, the broker will not allow us to open it unless we have the margin necessary. So, if you happen to have a small account, you may not be able to open the trade.

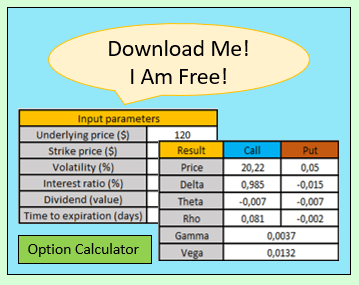

Where to get the short straddle option calculator?

Would you like to get the short straddle option calculator that we have been using in this article? No problem!

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Our advanced option strategy builder excel will allow you not only to create the short straddle, but any other strategy that you want!