What is a Short Strangle Option Strategy?

Of the many option strategies that we can perform, the short strangle option strategy is one of those that we can use to make money when we expect that the market is going to slow down and have a consolidation period.

Without the proper treatment, this strategy could be very dangerous because of a major flaw that it has.

In this article, we will be focusing on what is a short strangle option strategy, we will provide you with a very visual example and we will be using our advanced option strategy builder excel to show you the potential profit and loss of this strategy.

Table of Contents

What is a short strangle option strategy?

The short strangle option strategy is a neutral selling strategy formed by two Out of the Money options, one call and one put.

Typically, the short strangle option strategy will be sold when the underlying price and the strike price of our options are equidistant from one to another.

However, if we feel that the market is going to be more biased to one side or the other, we can easily pick a farther strike for the call or for the put.

Let us take a look at an example of a completely balanced short strangle option strategy.

A balanced short strangle option strategy example

As we saw with the long strangle option strategy, we are going to be picking exactly the same underlying for this example, over Match Group stock.

We are going to assume that the underlying is at $113, and we expect that it is going to stay flat because we had very strong moves some days ago, and the market is now getting quieter.

For this reason, we will be selling the Out of the Money call option $116 strike and the Out of The Money put option contract, whose strike price is $110. In both cases, the volatility is about 35%, so let us take a look at the option strategy builder calculator to discover how much we are going to receive when opening this trade

Short strangle option strategy calculator

As it can be seen, for every short strangle option strategy that we decide to open, we will be receiving $2.01. So, for our strategy to fail, the stock price should rise above $118 or fall below the $108 threshold.

Take a look at the following image, where we have colored the zones in the graph in which we will make money or lose it. This image comes from the ProRealTime charting software.

Short strangle option strategy behaviour

It is exactly the opposite situation we found in the long strangle option strategy.

The red area, the area in which we would lose money at the expiration date, is found above $118 and under the $108 threshold, while we will keep the premium the buyer paid us if the stock price remains in the green area.

However, as we said before, we have a major flaw with this strategy, and that is the deeper the price falls into the red area, the higher the losses.

However, according to our delta probabilities, this is very unlikely to happen.

Short strangle option strategy example payoff diagram

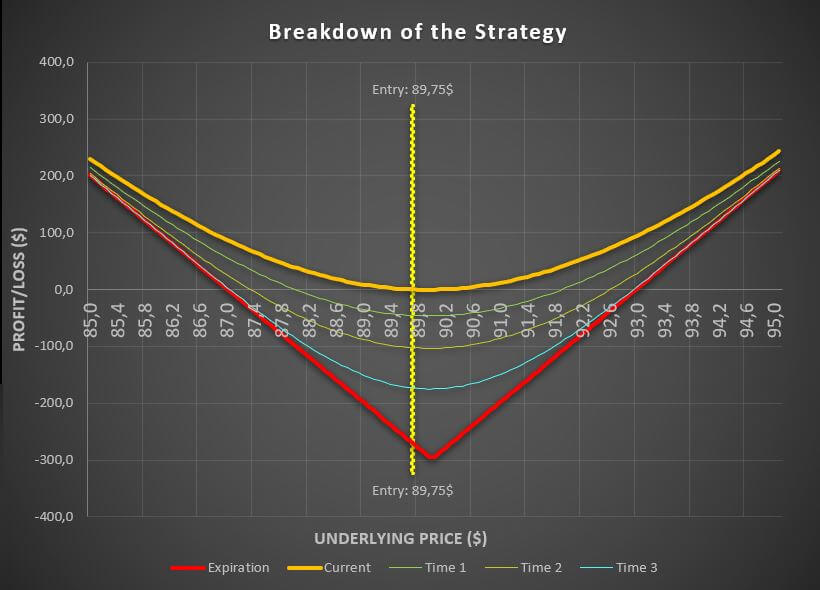

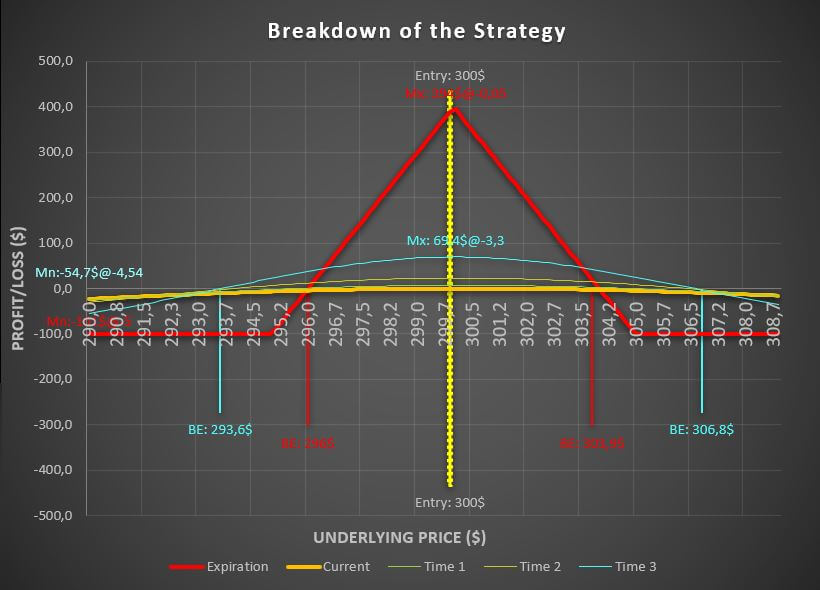

To help you understand a little better how our short strangle option strategy works, the best thing we can do is to show the graph of the performance of the strategy with our Advanced Option Trading Calculator Excel

Short strangle option payoff diagram

As you can see, when the expiration date approaches, the value of our short strangle option strategy begins to rise because of the time decay of the Out of the Money contracts.

Option strangle calculator data

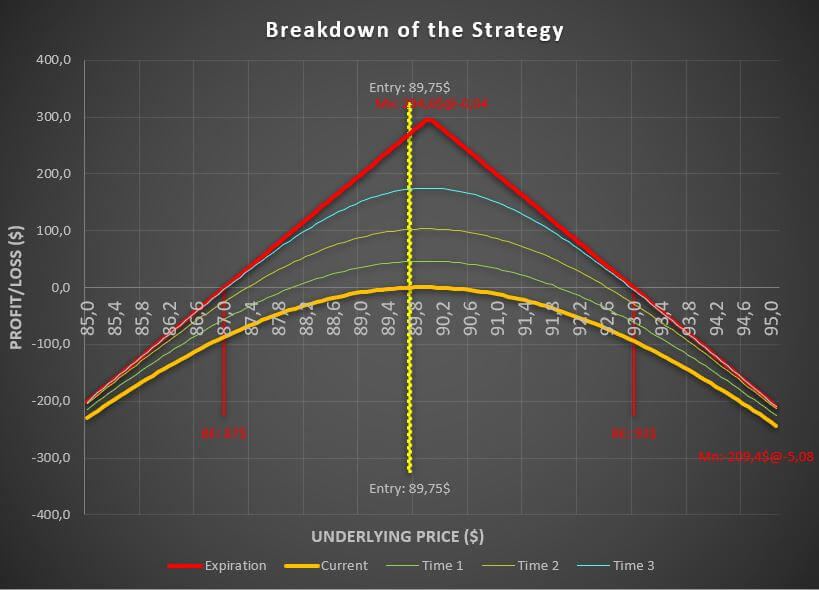

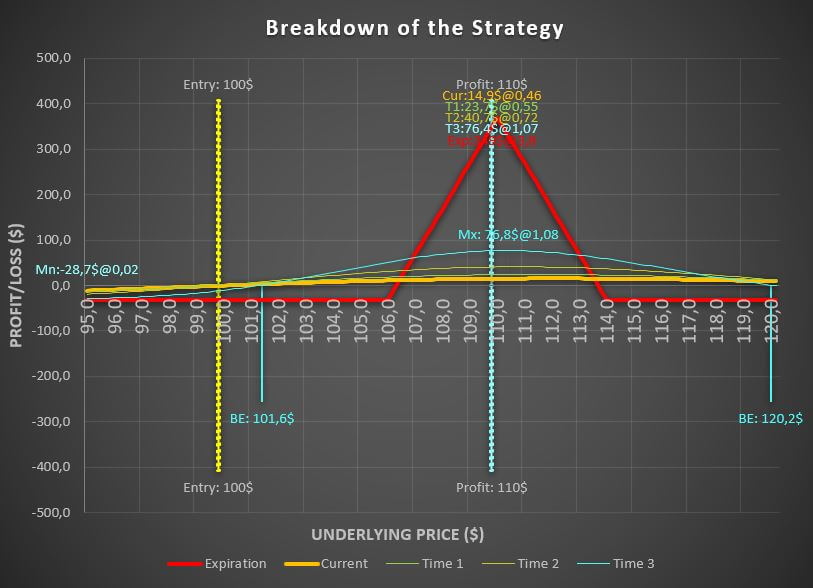

In the previous table, you can check the exact values that we could expect from a short strangle option strategy at the expiration date.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Opening an unbalanced short strangle option strategy example

Now, we are going to suppose that we believe that the underlying price, while it will not be moving too much, we think that is going to be bearish.

That being said, we could open the short strangle option strategy with a call strike price closer to the current underlying price, because we think that the stock will go down, or at least we think that is more probable.

If we open the short strangle in this situation, our potential profit will be higher. Let us suppose that we open the call strike price of $114 instead of the $116 that we used in the balanced example.

Short strangle option profit calculator

In this case, we will receive $2.71 when we open this strategy compared to the $2.01 that we got from the previous example. Let us take a look at the short strangle option strategy payoff diagram now.

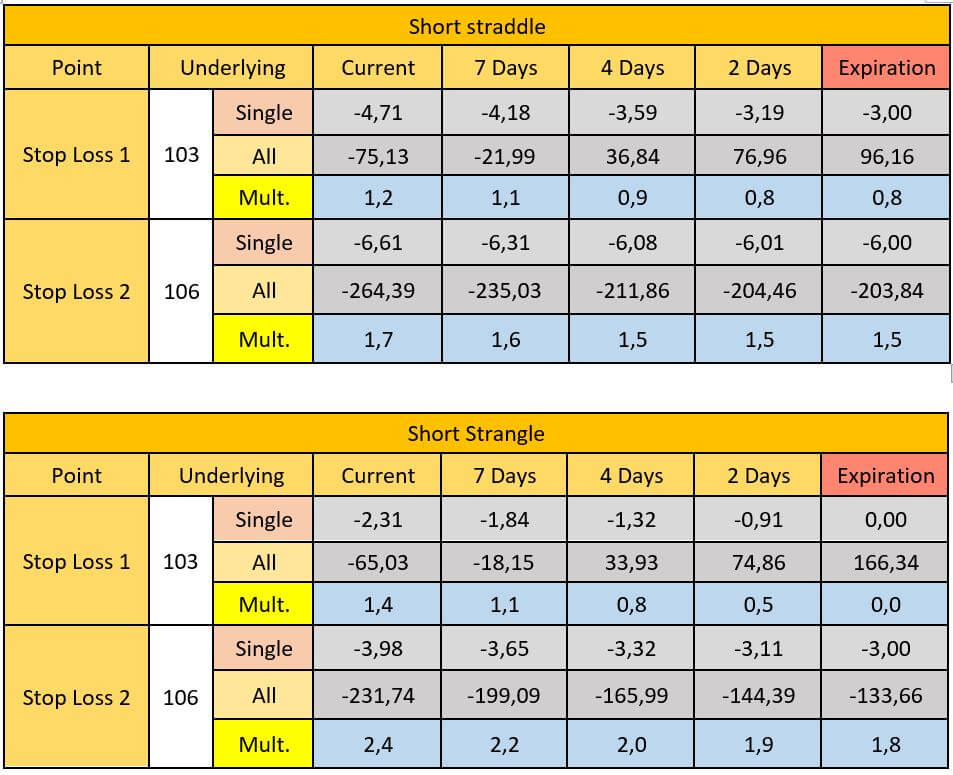

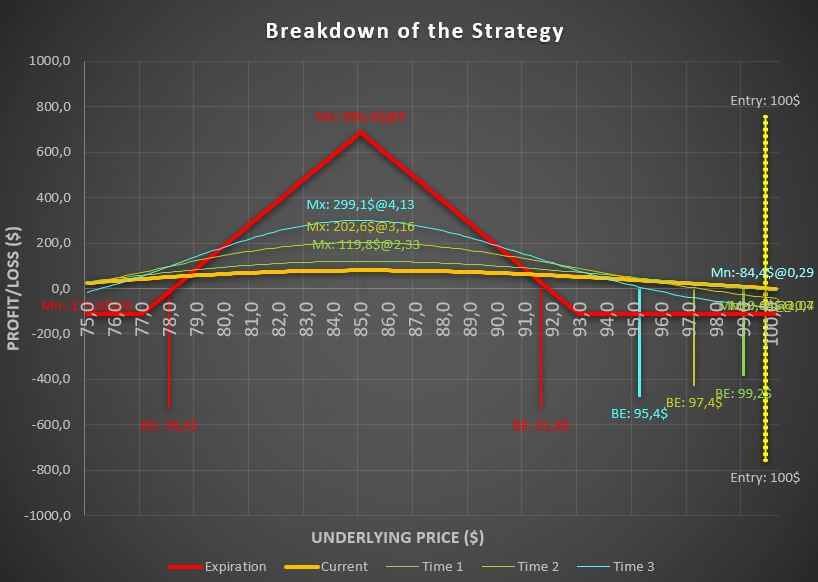

Short strangle option payoff diagram

As you can see, the break even points have changed in the expiration, compared to what we had before. Even when we have increased the maximum profit, we have narrowed the area in which we get profits.

Take a look at the following table to learn the exact values.

Unbalanced short option strangle payoff diagram

Short strangle option strategy risk and maximum profit

Every time that we open a short strangle strategy, the maximum risk is unlimited in theory. In practice, it will be much higher the farthest the underlying price is from any of our strike prices.

However, in this strategy, the maximum profit is limited to the premium that we have received when opening the trade.

The advantage is that we have the probability of winning by our side, but we really need to keep an eye on the risk.

In the short strangle option strategy, low volatility and time decay are our friends.

Short strangle option strategy margin requirement

In this case, as we are shorting Out of The Money contracts, our broker is going to ask us quite a lot of money to let us open the trade. The reason is we must provide insurance that, in the case, we end up assigned, we can pay the buyer the money we have to.

Even when it is not very probable that any of the legs of the short strangle option strategy ends up assigned, the broker will not allow us to open it unless we have the margin necessary.

So, if you happen to have a small account, you may not be able to open the trade.

Where to get the short strangle option calculator?

Would you like to get the short strangle option calculator that we have been using in this article? No problem!

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Our advanced option strategy builder excel will allow you not only to create the short strangle, but any other strategy that you want!