What is a Long Strangle Option Strategy?

Of the many option strategies that we can perform, the long strangle option strategy is one of those that we can use to make money without caring too much about the direction of the market

Even when that sounds great, we really need to be careful when using it, because it has a major flaw that could make lose our mind.

In this article, we will be focusing on what is a long strangle option strategy, we will provide you with a very visual example and we will be using our advanced option strategy builder excel to show you the potential profit and loss of this strategy.

Table of Contents

What is a long strangle option strategy?

The long strangle option strategy is a neutral buying strategy that is formed by buying two options, one Out of the Money call and one Out of the Money put

Typically, the long strangle option strategy is bought when the underlying price and the strike price have the same distance for the put and for the call options, but the truth is we can open the long strangle in any given condition.

However, depending on how far we pick the strike prices of the long strangle option strategy from the current underlying, the strategy could be unbalanced and biased to be more bearish or bullish.

Let us take a look at an example of a balanced long strangle option strategy first

A balanced long strangle option strategy example

For example, we are going to be trading stock options over Match Group stock. The stock price today is at $113, and we are expecting a big movement in the stock due to the earning reports that the company is about to publish.

As we are not entirely sure how the general sentiment of the report is going to affect the stocks, we are going to open a long strangle option strategy, so we are confident we are taking part in the movement.

For this reason, we will be buying the Out of the Money call option $116 strike and the Out of The Money put option contract, whose strike price is $110. In both cases, the volatility is about 35%, so let us take a look at the option strategy builder calculator to discover how much we are going to pay to open the position.

Long strangle option calculator

As you can see, in both cases, we are taking a seven days expiration period. In the call option, we will need to pay $1.04, and for the put option, we will need to pay $0.97. So, in other words, to be able to open the long strangle, we have to pay $2.01 in total.

Now, we should expect that the earnings reports provide a strong movement in the market. However, to be able to identify how far should the stock price needs to move, the best thing is to take a look at the chart provided by ProRealTime charting software.

Long strangle option example

The blue lines marked in the chart represent the strike prices of both contracts. The red area is the zone in which we will lose money with the option strangle strategy. The green zone indicates the are in which our long strangle strategy will make money.

As you can see, in order to make some money, the stock price has to rise quite above the call option strike or fall quite below the put option strike, and that is a very hard thing to happen.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Long strangle option strategy example payoff diagram

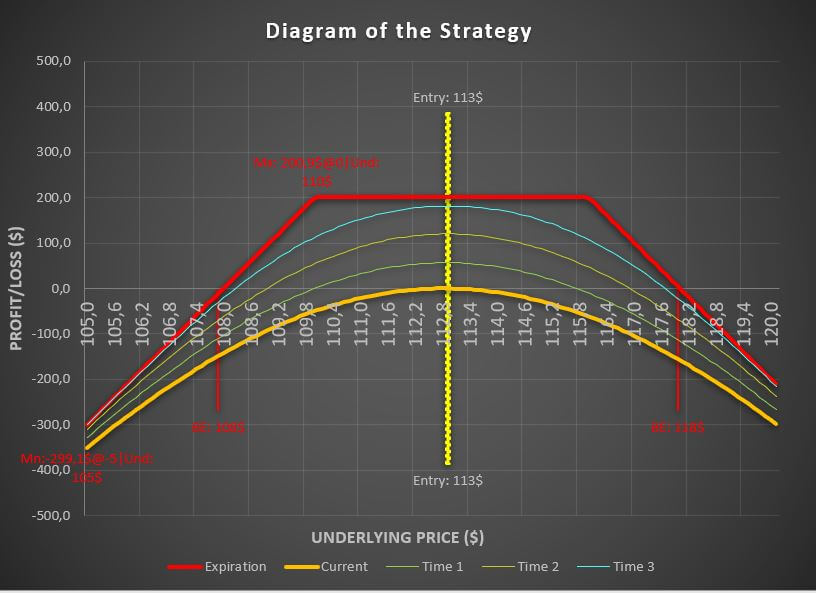

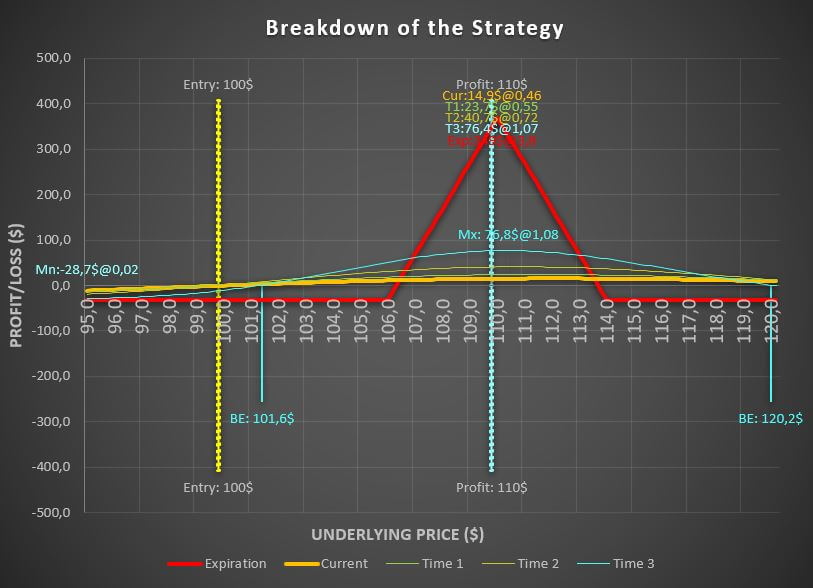

To understand a little better how our long strangle option strategy works, the best thing to do is to graph the performance of the strategy with our Advanced Option Trading Calculator Excel

Long strangle option payoff diagram

As you can see, when the expiration date approaches, the value of our option strategy decreases because of the time decay the long Out of The Money contracts have.

If, before the expiration date, the stock price manages to close up near the strike price, we might still make some profits. However, such a movement is hard to see in the near term.

Long strangle option payoff diagram

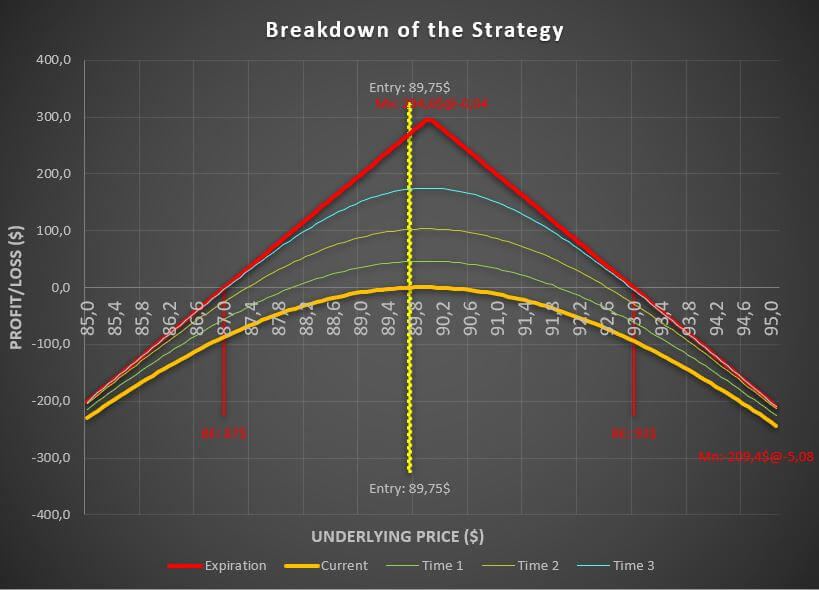

Opening an unbalanced long strangle option strategy example

Let us suppose now that we thought that the underlying price was going to rise, or at least, that we believe it is more probable a price rise.

In that case, we could open a long strangle option strategy with a call strike price that is closer to the current underlying price, compared to the put strike price.

That would increase the profits of the strategy in case the stock price rise. Let us take a look now at the long strangle option calculator with a call strike price of $114 instead of $116

Unbalanced long strangle option calculator

While it is true that we now have to pay $2.71 to open the unbalanced long strangle option strategy compared to the $2.01 from the previous example, we will see that the profits are better in this case.

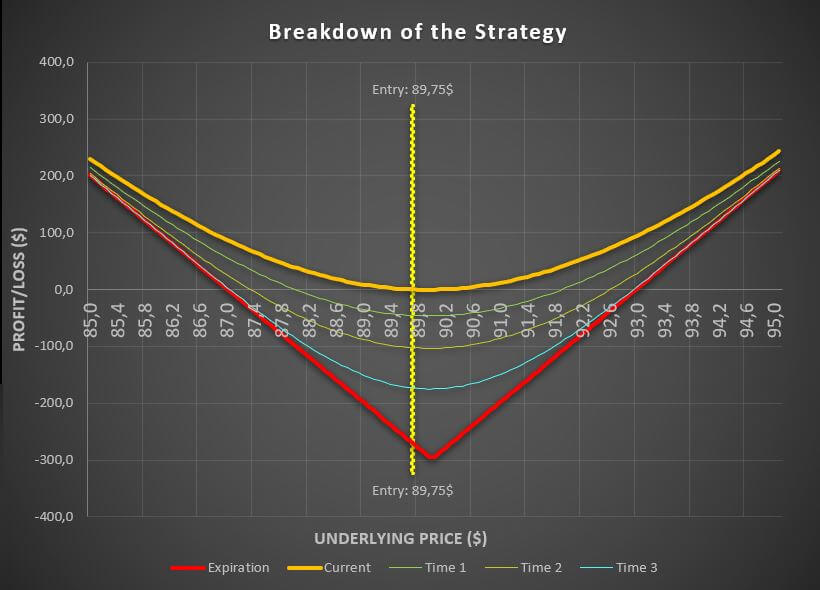

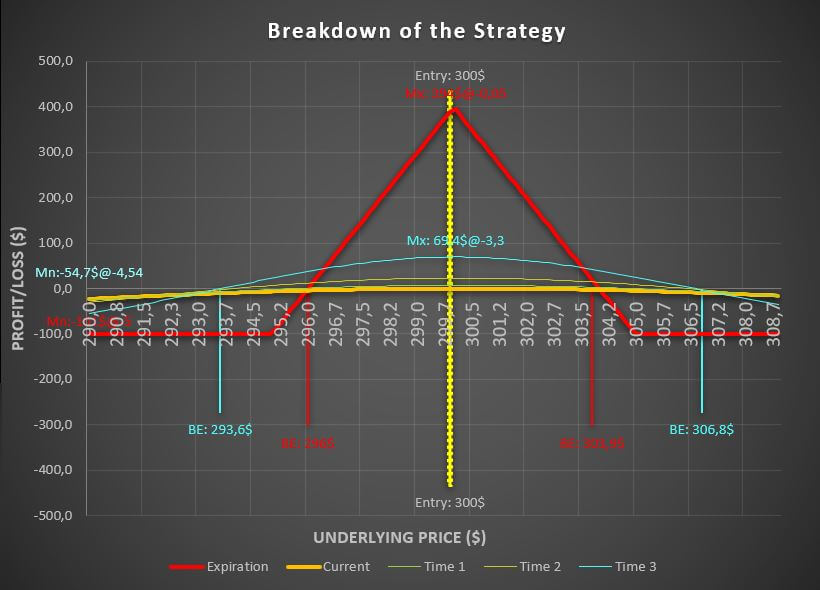

Unbalanced long strangle option payoff diagram

As you can see, the diagram is very similar in shape and form compared to the previous long strangle option strategy example, but what we need to look at is the profit.

In the previous example, if the price rose to $120, the long strangle option strategy would provide us with $199.1 at the expiration date.

However, in this case…

The unbalanced long strangle option strategy example would provide us with $329 at the expiration date, which is quite better.

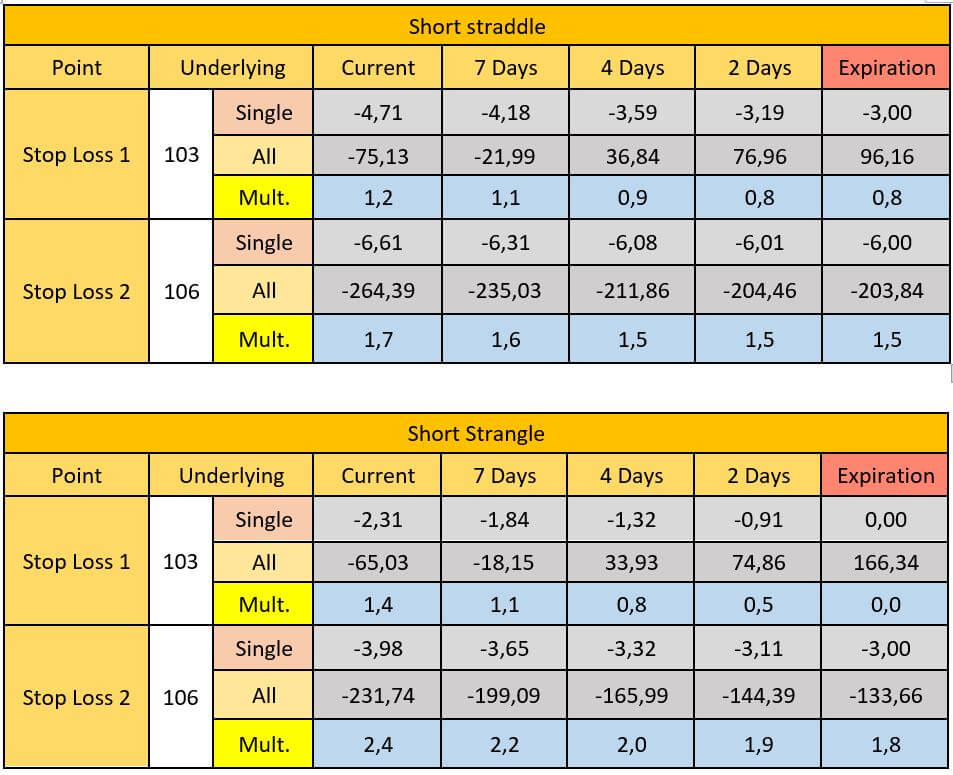

Long strangle option strategy risk and maximum profit

Every time that we decide to open any kind of long strangle strategy, the maximum risk is defined by the premium we paid when we opened the trade.

We will never be able to lose more than that.

However, in this strategy, the maximum profit is unlimited in theory. In practice, the profit will be higher the stronger the underlying price moves.

When to use long strangle strategy

The long strangle option strategy is better used whenever we expect a high volatility environment in the market, such as an earnings report, for example.

However, you must keep in mind that the long strangle has a major flaw: if the market does not move, our trade will be losing quite a lot of its value because of the low volatility.

Also, we need fast movements because time decay will be lethal to our long strangle option strategy.

Long strangle option strategy margin requirement

In this case, as we are dealing with long Out of The Money contracts, the broker is not going to ask us for any margin requirement. In other words, we will be able to execute this trade using a cash account.

The reason is because the highest loss we can achieve is already determined by the money we paid to open the position, and nothing more.

Where to get the long strangle option calculator?

Would you like to get the long strangle option calculator that we have been using in this article? No problem!

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

Our advanced option strategy builder excel will allow you not only to create the long strangle, but any other strategy that you want!