What is the Put Butterfly option strategy?

Of the many different option trading strategies that exists in the market, the put butterfly option strategy is a very interesting alternative for those traders who wants to open a bearish position in the market while taking advantage of time.

In this article, we are going to be focusing on what is the put butterfly option strategy, we will be learning how to take the best from it and how to use the time decay in our favor.

Table of Contents

What is the put butterfly option strategy?

The put butterfly is an option strategy that can be used either as a directional or a neutral strategy, but it works better when we use it as a bearish directional trade.

The strategy is formed by buying and selling four Out of the Money put options. The put that we sell are usually taken with the same strike price, while the strike price of those puts that are bought will be taken at the same distance from the sold ones.

The put butterfly is the bearish counter part of the call butterfly option strategy.

Let us just take a look at an example of the long put butterfly spread.

An example of the long put butterfly option strategy

Let us suppose that we want to trade a long put butterfly option strategy on a stock whose underlying price is $100. We have made our analysis and we believe that the stock is going to fall in the next 14 days up until $85.

So, we will open a long put butterfly spread. First, we will sell two put options with a strike price of $85, and then, we will buy one put option with a strike price of $80 and another one with a strike price of $90.

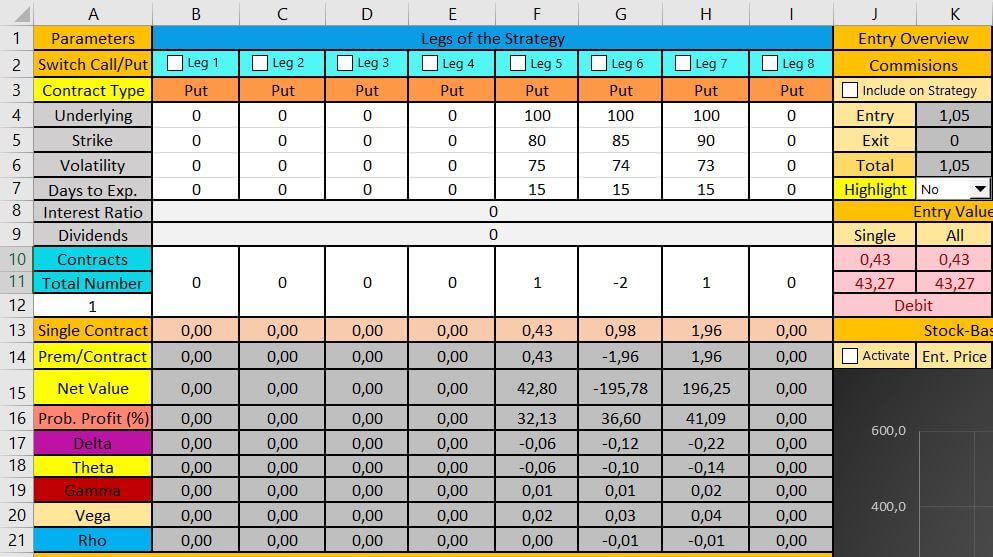

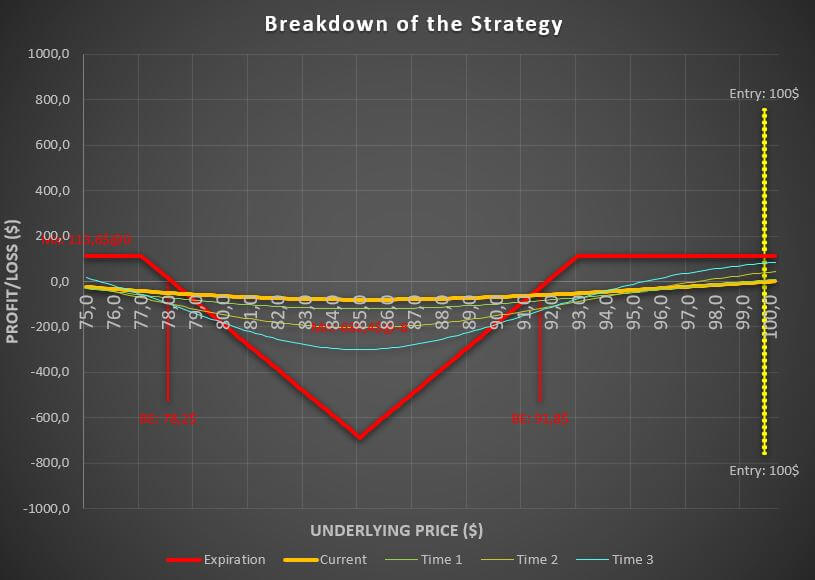

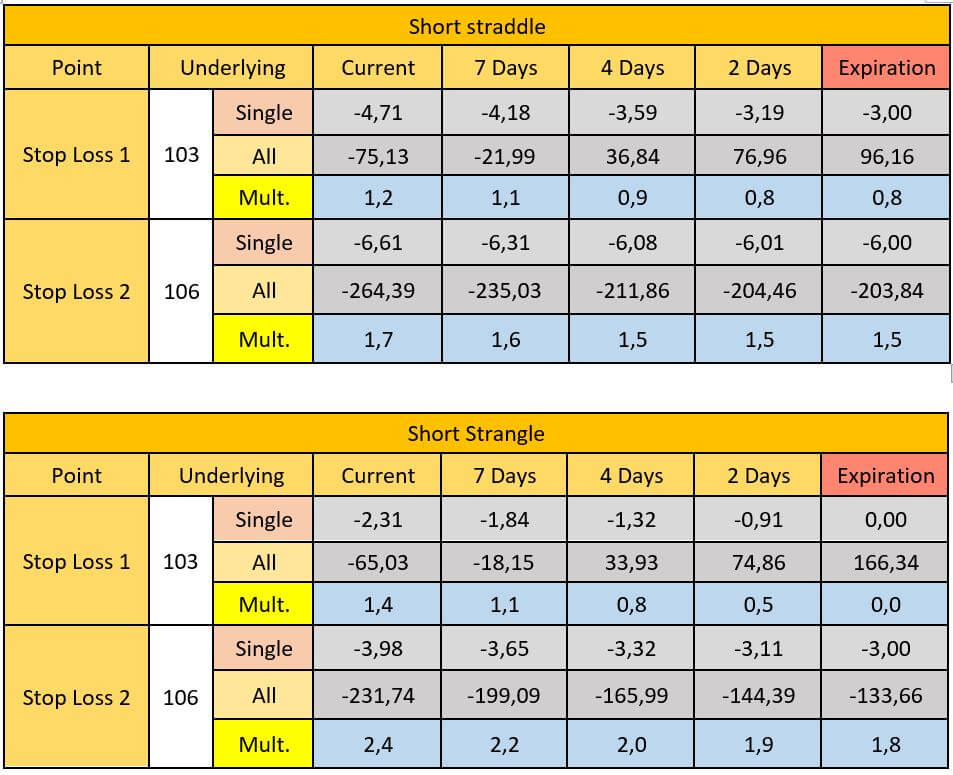

The result of this trade can be seen in the following image of our option strategy builder

As it can be seen, for opening one single long put butterfly spread, we will have to pay $43 without commissions. However, be aware that the commissions on a trade like this are quite high, because we are trading with four options at the same time.

We could expect commissions rounding about $4 or $5 in total for the entry alone. In any case, to better understand how this strategy works, let us take a look at the diagram.

Understanding the long put butterfly spread payoff diagram

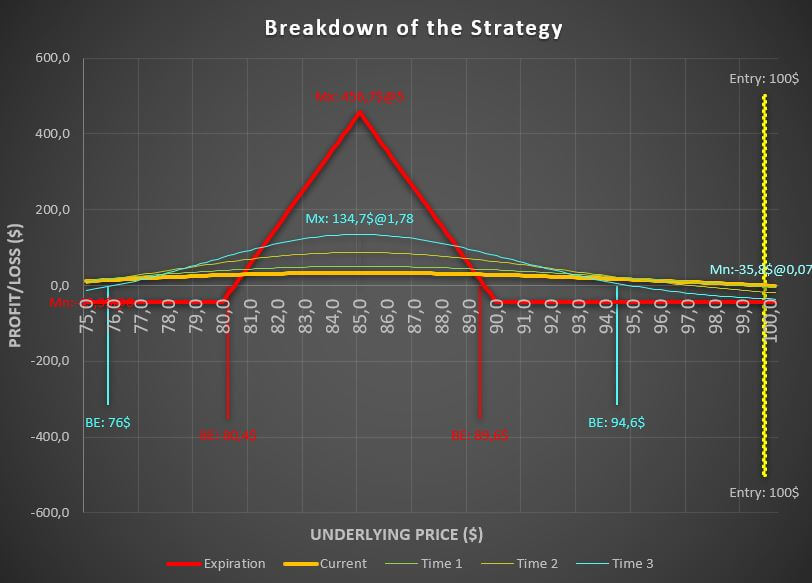

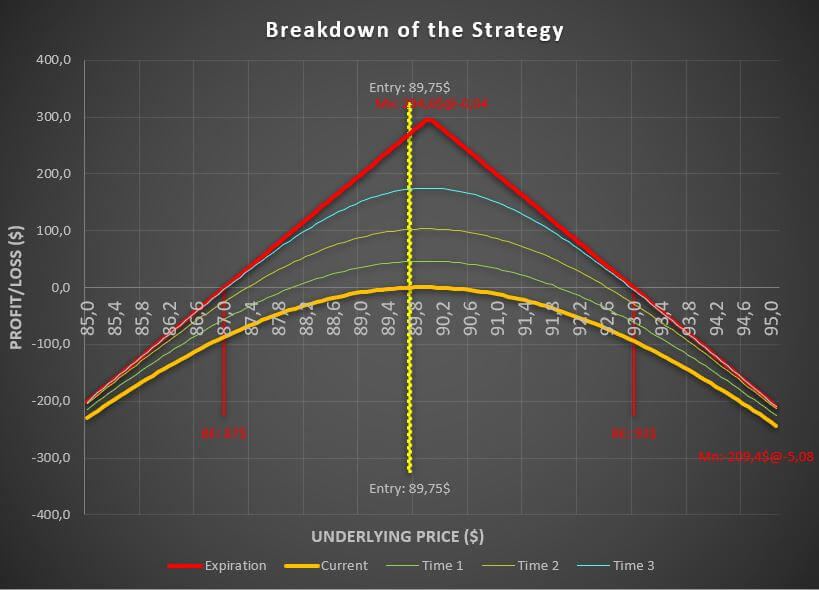

In the following image, we can see the expected payoff diagram for this trade.

As it can be seen, the maximum profit that we could take on this trade is $456,7 if the underlying price is exactly at $85 at the expiration date. However, we should keep in mind that this is not very probable.

As for the maximum loss possible, the long put butterfly option strategy risk is set once we enter the trade by the premium we paid to open it.

So, yes, this trade has a very high risk/reward ratio and it is arguably better than many other buying strategies out there. But, as you can see on the previous graph, the value of the butterfly will increase as the time passes.

Let us now analyze the effects of volatility and time decay in this strategy.

Effects of time decay and volatility on the long put butterfly option strategy

First, let us focus on the effects of the volatility on the strategy.

Just like many other strategies, an increment on the volatility will damage the results of the diagram. While, at the other hand, if the volatility is reduced while we are in the trade, the payoff diagram will be better.

Volatility increased by 30

Volatility reduced by 30

Now, let us focus on the effects of time decay.

Time decay on the long put butterfly spread

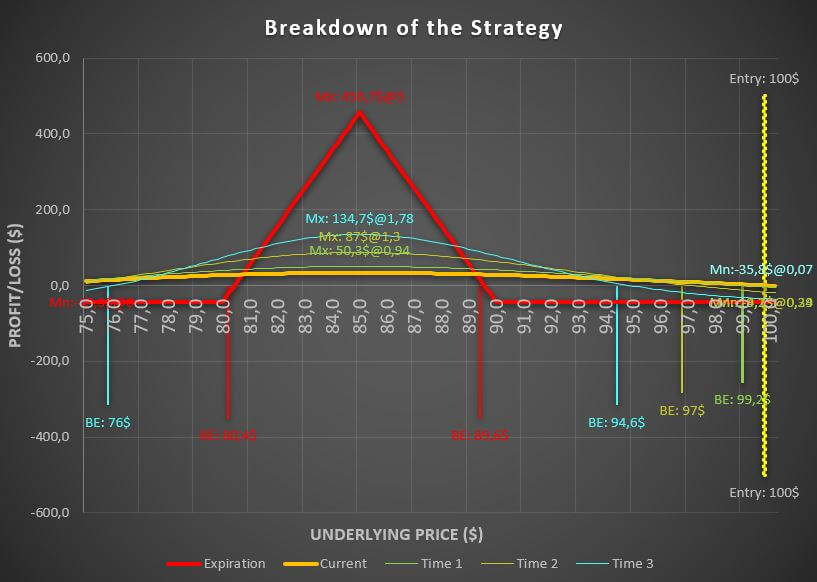

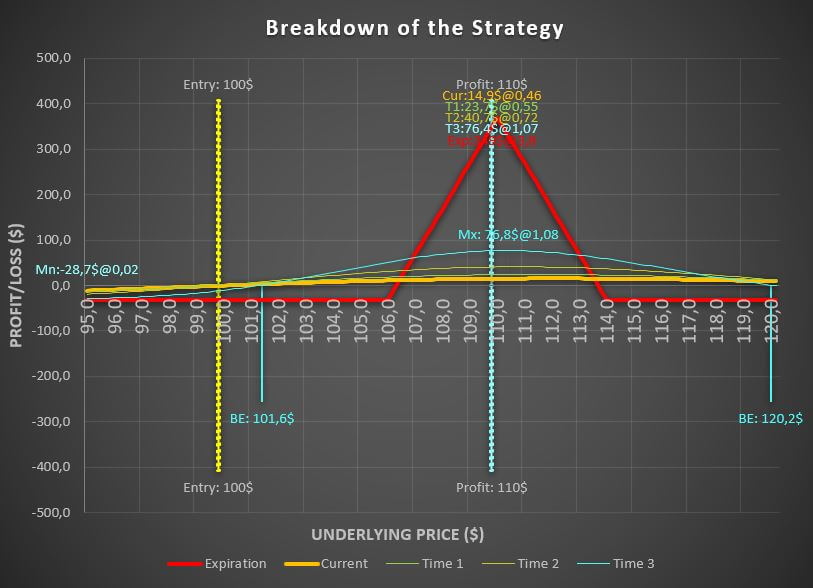

In the graph, we can easily see how time decay is the key in the long put butterfly option strategy. In the following image, it is possible to see how the strategy will take and extreme advantage when it approaches to the expiration date.

However, in the case that the underlying price begins to go down with strength, we will not get as much profit as we would expect.

The main advantage and disadvantage of the long put butterfly option strategy is both the dependency on the time decay.

Some tips to improve the long put butterfly spread

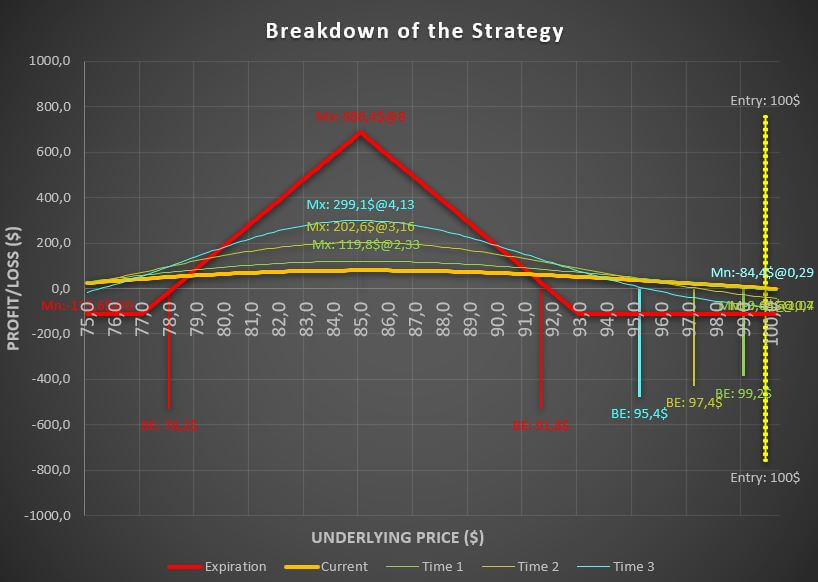

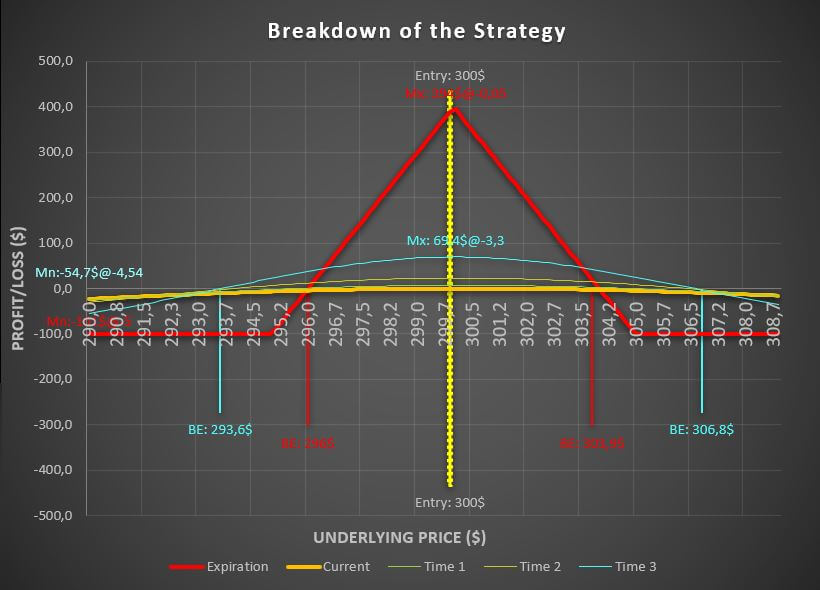

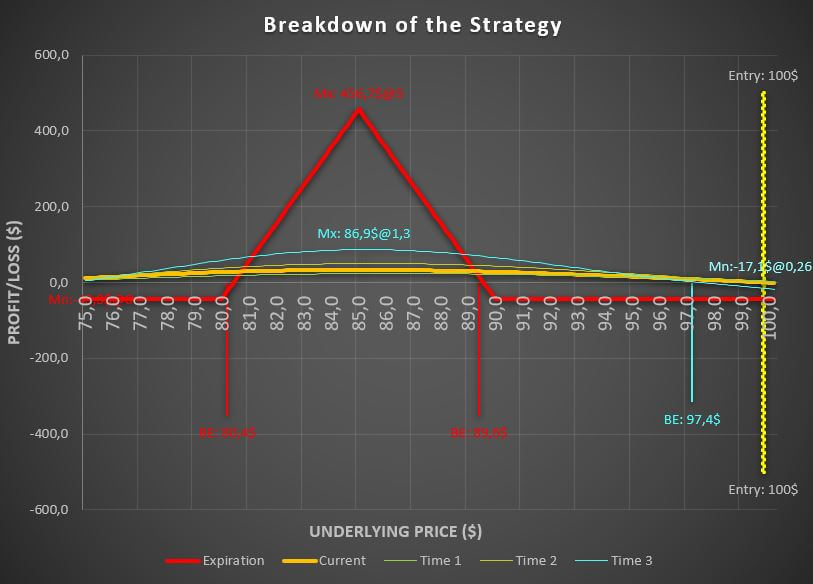

Now, if we wanted to increase the probability of obtaining a better profits with the put butterfly, the only thing we need to do is to take the strike price of the puts that we bought with a farther distance from the short puts.

For example, if we picked the $77 and the $93 strike prices for the puts, while it is true that we will have to pay more for opening the trade, the area of profitability will be increased and the strategy will not rely so much on time decay.

In this case, we are paying $114 to enter the long put butterfly spread

Example of the short cput butterfly option strategy

While other strategies such as the strangle has a long and a short version, it is not the case for the put butterfly spread.

Not that the short put butterfly option strategy does not exists. What we mean is that the short version makes no sense to be used because it has no point.

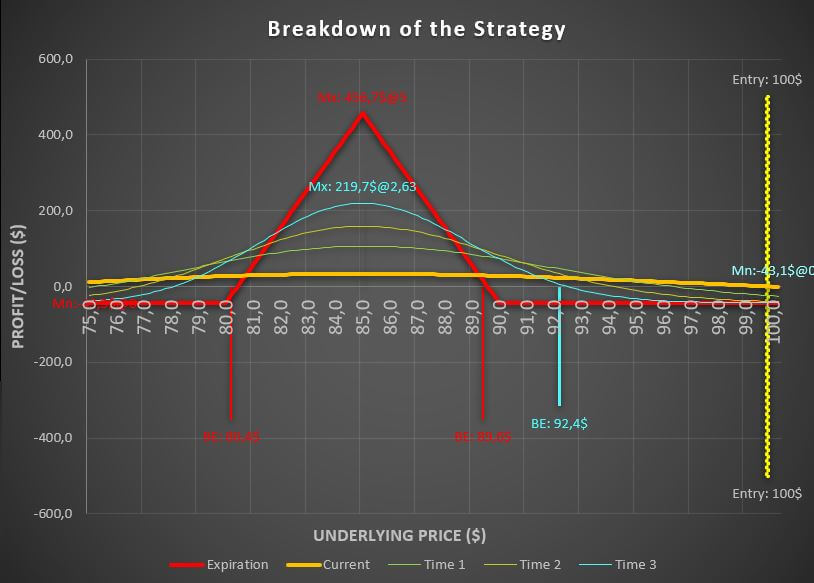

We are going to reverse the trade that we saw in the previous example to help you understand what we mean.

As it can be seen, there is no point in obtaining a profit of $113 while we are facing a potential risk of losing $654.

That is the reason why the short put butterfly option strategy is pointless in trading options.

When to use the put butterfly option strategy?

We should use this strategy in those situations in which we believe that the underlying price is going to go down but we expect that it will take some time to reach a certain price.

Remember that the long put butterfly spread will take advantage of time decay, so if we are right on direction and time, we could make a lot of money because of the incredibly high risk/reward ratio the strategy provide us.

Where to get the long put butterfly strategy calculator?

Would you like to get the long put butterfly strategy calculator that we have been using in this article? No problem!

Do you need a Calculator that helps you create and analyze any option strategy in record time?

Our advanced option strategy builder excel will allow you not only to create the long butterfly spread, but any other strategy that you want!