Understanding the Bearish Put Backspread Option Strategy

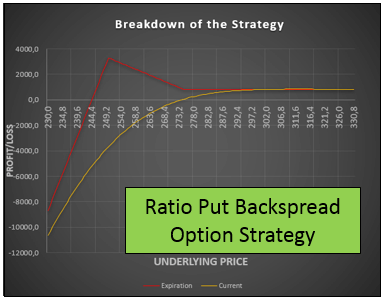

The put backspread option strategy is a surprisingly uncommon option strategy that will allow us to obtain profits when the underlying price goes either up or down for a certain period of time.

In this guide, we will discuss the put backspread option strategy. We will learn how to use it in our favor and how to spot the put backspread risks and profits with our option price calculator excel.

Table of Contents

What is a put backspread option strategy?

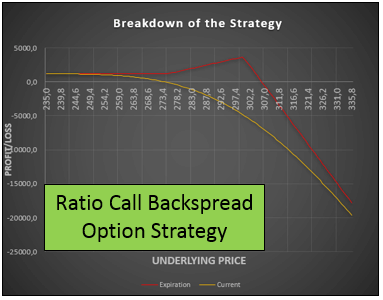

The put backspread option strategy is a multidirectional strategy with a stronger bearish perspective, unlike the call backspread, which is a bullish strategy.

The put backspread allows us to make some limited profits when the underlying price rises over a certain threshold. At the same time, if the stock price of the asset begins to drop more and more in value, our profits are unlimited, just like in the case of a long put option.

However, the only scenario where the strategy will lose money is when the stock price stagnates between the two strike prices of our strategy. The good news is the put backspread risk is completely limited, as we will learn later.

How is a put backspread option strategy composed?

In order to create the put backspread option strategy and to profit from it, the most typical approach is to sell an At The Money put option while at the same time buying two Out of The Money put options.

The objective is this: we need to receive a credit for the sold put, and that credit should pay the two Out of The Money put options we bought and leave us with some profit for just opening the put backspread.

Configuring the put backspread option strategy in this way, we are limiting the profits to the upside, while we are making them unlimited to the downside.

When to use the put backspread option strategy?

The put backspread option strategy is better used when we are certain that there is going to be a movement in the asset we are dealing with, and we believe it is going to be to the downside.

To help us identify the direction of the active, we could use a technical analysis tool such as the TTM Squeeze, that will allow us to find trends and strong movements.

With the put backspread, we are covering both sides of the market, just like a long strangle or a long straddle would do, but with a lower risk and a more bearish perspective.

The best way to understand how the put backspread risk and profits work is with an example over a real underlying.

Put backspread option strategy example

Let us suppose we want to trade a put backspread option strategy over the SPY, which is the ETF that replicates the behavior of the S&P500 index. As the United States elections are coming the next week, we are not very sure about what is going to happen in the market in the next 15 days.

What we know is that there is going to be a high volatility that could lead the market to either go down or go up. So, to take part in this move, if we somewhat believed that the stock market is going to fall, we could open this put backspread option strategy because we would be covering the risk to the upside too.

Do you need a Calculator that helps you create and analyze any option strategy in record time? |

In this case, as the SPY stock price is today at $323.66, what we are going to do is to sell an At The Money put option contract whose strike price is $324 while, at the same time, buying two Out of The Money put options whose strike prices are $313. We are going to assume a volatility of about 33% in both cases to simplify the matter.

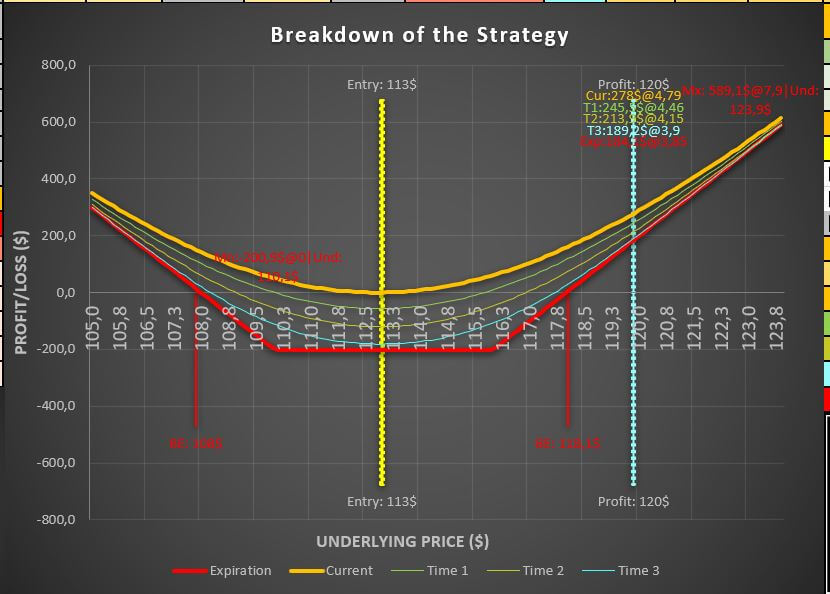

Let us take a look now at the put backspread calculator to learn the result of opening this trade.

In this case, the put backspread calculator is showing us the values of the legs. For the put option contract we sold, we will receive $8.43 as a net income. However, for the Out of The Money put options we bought, we will have to pay $3.90 each.

In other words, if we subtract what we paid from what we received, we will find a total net income of $0.63. Now, we should take a look at the SPY chart to understand what is happening in this situation

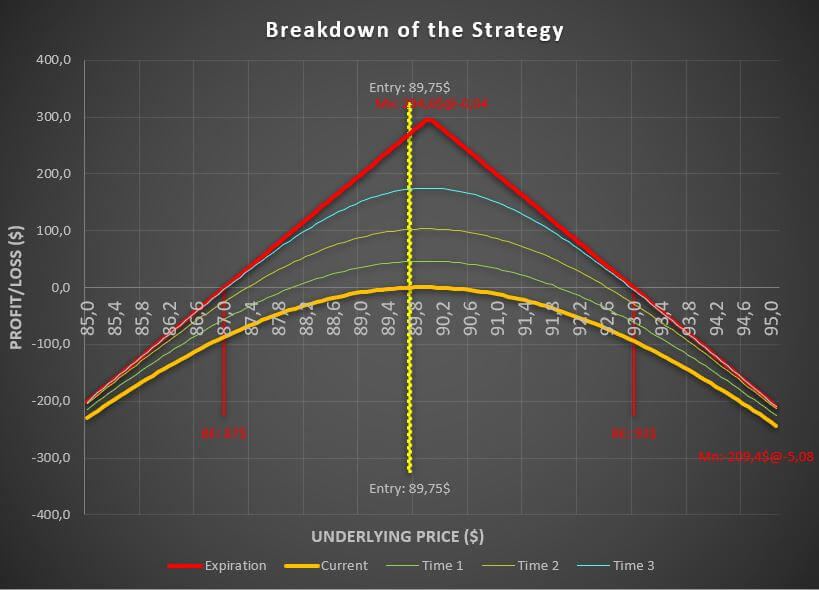

Breaking down the put backspread option strategy

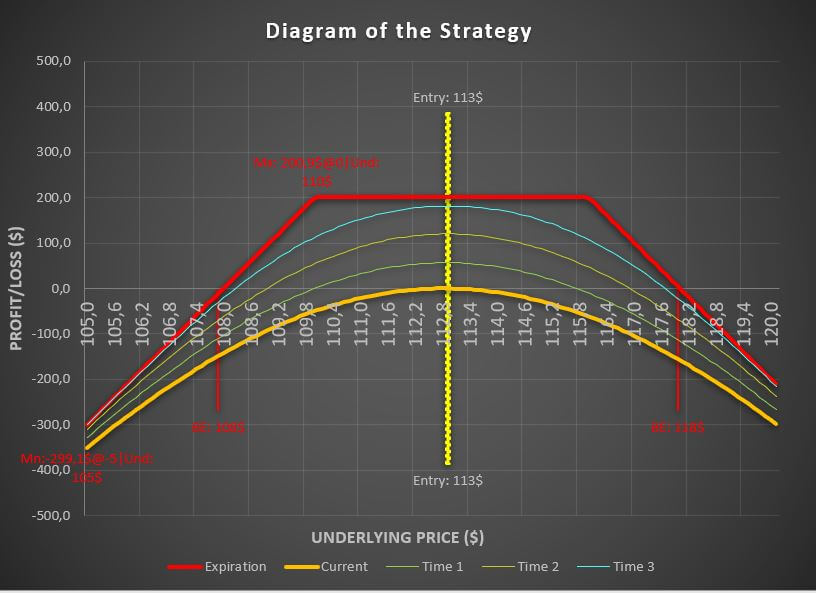

In the previous image, it is represented the put backspread option strategy. The orange lines are the strike prices of our put options.

As we can see, the green area of the chart represents the zones in which we would be making profits. If the SPY falls rise above $324, the maximum profit we would make would be $0.63, which is the remaining credit we had.

Simultaneously, if the SPY drops under $303, our long put options will begin to make some profits, and those are unlimited.

However, if the stock price stays in the red zone, we would produce a loss, but this is not very likely, as we have already determined.

To fully understand the put backspread risks, the best thing to do is to show the payoff diagram of this strategy.

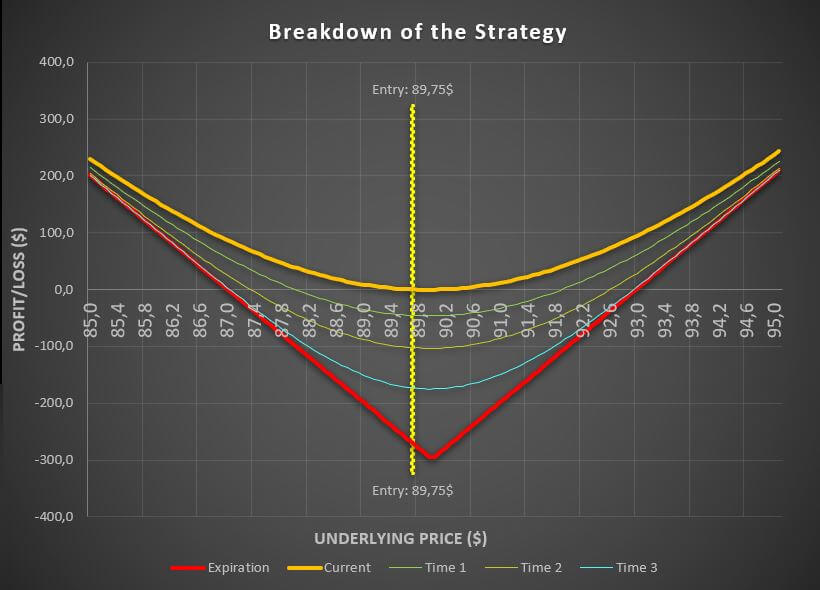

Put backspread risks, payoff diagram

To represent the diagram, we have used our put backspread calculator, in which we will be able to see the expected results at the expiration date.

As you can see in the put backspread calculator, we have a limited profit of $0.63 if the stock rises above the $324 mark and an unlimited profit to the downside.

If the underlying stays between these two areas when the expiration date arrives, the put backspread risk becomes higher. The maximum loss we can obtain in this case is when the stock ends up at $313, in which we would lose $10.37.

Put backspread option strategy margin requirement

As with any other option strategies that have a short-selling leg, the put backspread will also require a margin by the broker. In other words, we are going to need to use a margin account to be able to open this kind of trade.

In order to calculate this value, the only thing we need to know is the differences between the strike prices of our strategy.

Following the example of the SPY trade, as we were dealing with a short put option whose strike price was $324 and with another long put option whose strike price was $313, the margin requirement would be the difference between these two prices multiplied by one hundred

In other words, the margin requirement of the put backspread in this case is $1100. If we do not have that amount in our account, the broker will not allow us to perform the trade. We could always pick another strike price to reduce this margin requirement in the option chain if we still wanted to open the trade.

Last words about the put backspread option strategy

The put backspread option strategy is a multidirectional strategy that will allow us to make money whenever the market moves. Unlike other strategies like the Iron Condor option strategy, we need the put backspread to move to one direction or to another, so we should be aware of that.

We should always keep in mind to open the trade and make some net income in order for the strategy to work as intended and make the best of it.